Previously: Economics Roundup #1

Let’s take advantage of the normality while we have it. In all senses.

There is Trump’s proposal to replace income taxes with tariffs, but he is not alone.

So here is your periodic reminder, since this is not actually new at core: Biden’s proposed budgets include completely insane tax regimes that would cripple our economic dynamism and growth if enacted. As in for high net worth individuals, taking unrealized capital gains at 25% and realized capital gains, such as those you are forced to take to pay your unrealized capital gains tax, at 44.6% plus state taxes.

Austen Allred explains how this plausibly destroys the entire startup ecosystem.

Which I know is confusing because in other contexts he also talks about how other laws (such as SB 1047) that would in no way apply to startups would also destroy the startup ecosystem. But in this case he is right.

Austen Allred: It’s difficult to describe how insane a 25% tax on unrealized capital gains is.

Not a one-time 25% hit. It’s compounding, annually taking 25% of every dollar of potential increase before it can grow.

Not an exaggeration to say it could single-handedly crush the economy.

An example to show how insane this is: You’re a founder and you start a company. You own… let’s say 30% of it.

Everything is booming, you raise a round that values the company at at $500 million.

You now personally owe $37.5 million in taxes.

This year. In cash.

Now there are investors who want to invest in the company, but you can’t just raise $37.5 million in cash overnight.

So what happens?

Well, you simply decide not to have a company worth a few hundred million dollars.

Oh well, that’s only a handful of companies right?

Well, as an investor, the only way the entire ecosystem works is if a few companies become worth hundreds of millions.

Without that, venture capital no longer works. Investment is gone.

Y Combinator no longer works.

No more funding, mass layoffs, companies shutting down crushes the revenue of those that are still around.

Economic armageddon. We’ve seen how these spirals work, and it’s really bad for everyone.

Just because bad policy only targets rich people doesn’t mean it can’t kill the economy or make it good policy.

I do think they are attempting to deal with this via another idea he thought was crazy, the ‘nine annual payments’ for the first year’s tax and ‘five annual payments’ for the subsequent tax. So the theory would be that the first year you ‘only’ owe 3.5%. Then the second year you owe another 3.5% of the old gain and 5% of the next year’s gain. That is less horrendous, but still super horrendous, especially if the taxes do not go away if the asset values subsequently decline, risking putting you into infinite debt.

This is only the beginning. They are even worse than Warren’s proposed wealth taxes, because the acute effects and forcing function here are so bad. At the time this was far worse than the various stupid and destructive economic policies Trump was proposing, although he has recently stepped it up to the point where that is unclear.

The good news is that these policies are for now complete political non-starters. Never will a single Republican vote for this, and many Democrats know better. I would like to think the same thing in reverse, as well.

Also, this is probably unconstitutional in the actually-thrown-out-by-SCOTUS sense, not only in the violates-the-literal-constitution sense.

But yes, it is rather terrifying what would happen if they had the kind of majorities that could enact things like this. On either side.

Why didn’t the super high taxes in the 1950s kill growth? Taxes for most people were not actually that high, the super-high marginal rates like 91% kicked in at millions a year in income, and at that point loopholes allowed those people to largely dodge. Otherwise rates were not so high once you take into account social security taxes and medicare taxes. Also, who is to say the rates didn’t do a lot of damage? We don’t know the counterfactual and conditions were otherwise quite good.

The Orange Man is Bad, and his plan to attack Federal Reserve independence is bad, even for him. This is not something we want to be messing with. I do wonder how much Trump ‘consulting’ would matter. It is not like he was or would be afraid to make his feelings clear or make threats without formal consultations. This is an underrated reason to be concerned.

Also, if I was a presidential candidate running against the incumbent in a time when the Fed has to make highly unclear decisions on interest rates, I would not want to be very clearly and publicly threatening their independence.

Bloomberg story about New York State and its hyperaggressive pursuit of those who claim not to live in New York. New York it notorious for being by far the most aggressive jurisdiction about this. It is also clear that a lot of this is because New York has a lot of people, many of them in finance, who are doing their best to do the exact minimum necessary to claim they are not residents of New York. Meanwhile, they are constantly visiting, they keep a domicile in the state, and so on.

What I did not see were stories about people who definitely actually left the state, and were not coming back on the regular. Yes, the state is being obnoxious, but if your flight arrives at 12: 05am and then leaves at 11: 48pm, then that is the game you decided to play. Seems fair.

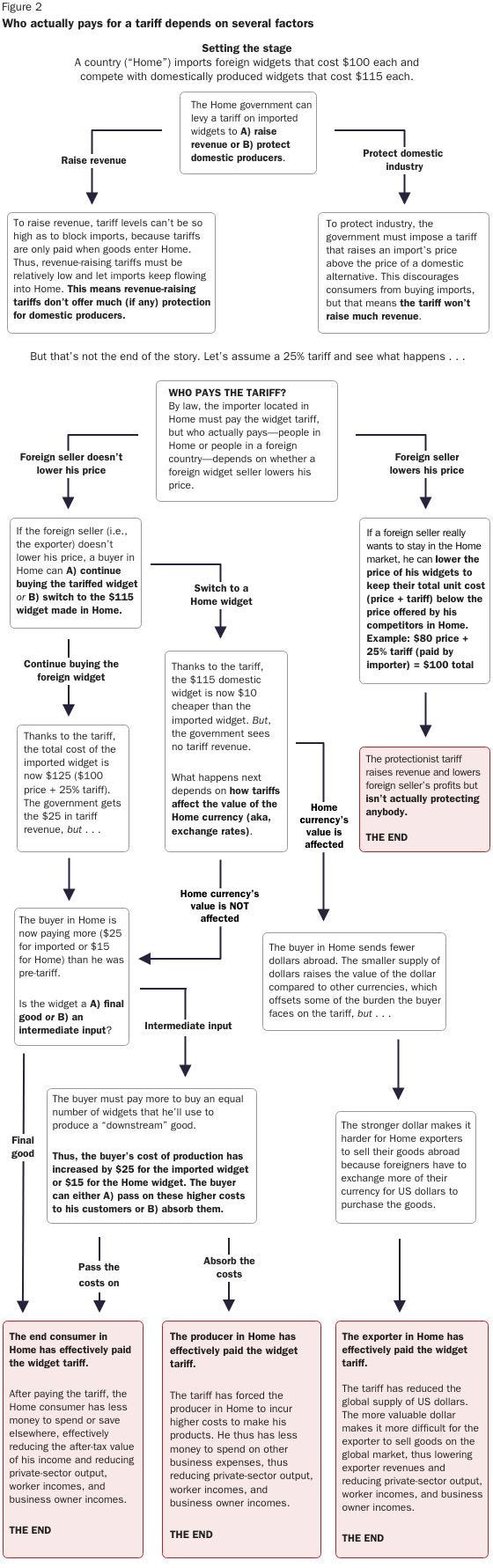

Who pays for tariffs? Cato suggests this handy chart.

This chart is very much trying to have its cake and eat it too.

It starts with a correct dilemma. Suppose a tariff is imposed.

On any given purchasing decision, consider a customer who would have otherwise bought a foreign good. They can either substitute the domestic good, pay for the foreign good or (not listed) substitute away entirely. If widgets go from $100 to $115, perhaps you buy less widgets and more thingamabobs.

If you get the customer to switch, no one pays the tariff.

If you don’t get the customer to switch, no one is protected.

The difference is that in the real world, preferences and use cases are continuous. What happens as you put in the tariff is that some of the customers switch. Some of the customers do not. The price of the foreign good is probably partially absorbed by the producer, partly by the domestic supply chain and partly by the customer. Economics of scale change production costs, expertise is learned, and so on.

To the extent the foreigners eat the cost and still sell, and there is no retaliation, that is a pure win for team tariff. We get money in the public coffers at foreign expense.

To the extent that purchases stay the same and we pay the cost domestically, that is indeed a tax paid by producers or consumers. Yes, it lowers their remaining capital, but is probably one of the least distortionary available taxes. In the terms described above, if you used the money to cut income tax rates, you’d probably be ahead.

To the extent purchases are switched, this is then framed above as ‘Home pays.’ This is a weird way of looking at this. No one is paying a tariff per se, what happened was we substituted domestic production for cheaper imports. This is good for the domestic producer of the widgets, and that has spillover effects to the rest of the economy, as does substituting this activity for other potential production. Whereas the buyer is worse off, which has spillover effects in the other direction in various ways.

The question is, do the benefits exceed the costs? That is hard to know. If you are using otherwise idle resources, gaining expertise and competitiveness and so on, then it could be good. If you are already at full employment and moving down the value chain, then this could be deeply foolish and bad.

What is weird is the claim that the exporter of different goods pays if the value of home’s currency changes. Presumably home’s currency changes in value slightly. But as they say this offsets the higher price ‘somewhat.’ In most cases, this seems like somewhat is very little in practice? So yes, exporters are worse off, but my expectation is the vast majority of the impact is still absorbed as per the rest of the chart. How important is this good to the dollar’s price?

My view of tariffs is that free trade is good. We should encourage more trade, not impose more tariffs, especially since they tend to trigger a response in kind. When Cato says that economists view tariffs as generally unwise and unhelpful, I agree. We would mostly be better off without them, even if others still imposed some on us.

However, it is not like our other tax options do not suck. Income taxes punish and reduce work. Capital gains taxes punish and reduce savings and investment and value creation. Value added taxes punish adding value, and so on. Cabron taxes and unimproved value of land taxes are great where you can get them, but the Pigou Club and Georgist Club do not have enough members at this time.

So if our other options are things like income taxes and capital gains taxes, a one-way tariff that doesn’t change anything otherwise seems to me like it should be about as bad as those. What (as I understand it) makes tariffs such bad taxes in the baseline case is that other countries respond in kind when you impose them, and those countries like you less on all levels, and international relations deteriorate, and so on.

New confirmation of the IDoBadTakes theory of inflation hatred:

Alec Stapp: Twitter figured this one out five months ago.

IDoBadTakes: The economy can be summed up by an experience I had at a recent family reunion. Everyone was complaining about how shit the economy was and how expensive everything was

I pointed out that for the first time ever, every adult present had a good paying job they liked.

Three people present had just been bragging about doubling their salaries. 2 people had just gotten back from their first ever Europe trips. The raises and the jobs were things they felt they had earned. The prices going up were the government’s.

Arin Dube: Great new work by @S_Stantcheva on why people hate inflation, following up on Shiller (’97).

Big reason: people tend to ascribe wage gains to own efforts, and price inflation to policy. Esp true for those changing jobs (key source of recent wage gains).

In our work, we find a big part of the reduction in wage inequality was from very sharp change in bottom wages–driven by people moving out of bad jobs into better ones (aided by a tight labor market). This type of wage gain was particularly unlikely to allay inflation concerns.

Stefanie Stantcheva: Inflation is most definitely not seen as just a “yardstick,” but as causing tangible adverse effects. The predominant reason for aversion is clear: People believe that their wages are not keeping up with inflation and that that their living standards are declining.

The perception that wages don’t keep up with prices is amplified by the belief that wage raises during inflationary periods are not adjustments for inflation but instead due to job performance & progression. This belief is strongest among those who switch jobs during this period.

Why do wages lag behind prices? People believe employers have substantial discretion rather than being subject to market forces. The belief is that when employers don’t raise wages, it’s because they choose to do so to keep their profits high.

…

Large partisan split in who people blame for inflation. On the left, it is mostly businesses and “greed”, on the right it is “Joe Biden,” the administration and the government.

Do wages lag behind prices? The argument there would be that only after prices go up can you then ask for a raise based on inflation. But that assumes that we have commodity-driven inflation, rather than wage-driven inflation. Alternatively, one could argue that wage-driven inflation would be concentrated in the places where workers have the leverage, so even then most workers would be responding to changes elsewhere, and lag behind. And also wages are sticky downwards and costly to adjust, so it makes sense that they would in some sense lag behind if there was a one-time inflation shock or shift in expectations. But also it seems odd to talk about ‘lag’ at all if inflation is steady.

There was talk that we should be using an older inflation calculation. Scott Sumner points out that if you use the old inflation calculation, that puts greater weight on financing costs, it suggests +28.6% CPI between 11/21 and 11/23 with NGDP +13.4% and consumption +12.9%,which implies a major depression that we can all see did not happen, for example car sales are up not down, and a ~20% decline in effective compensation, which also obviously did not happen despite higher financing costs.

As Scott says, the question is what is the most useful measure. There is no one definitive inflation number, you are measuring many different things. Financing costs going up means that, for certain important purposes, costs really are way up recently, whereas the baseline cost of living for most people is not. I do think people are reacting to all of this in a not-so-crazy fashion.

Still, he notes that inflation does look too high, and we should worry it is reaccelerating. And it is clearly central to why people think the economy is bad.

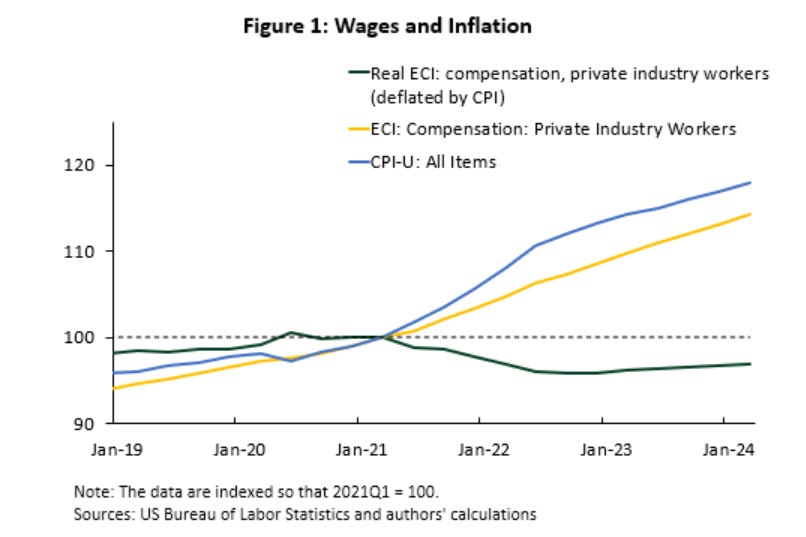

Scott Sumner: Americans view the economy as poor partly because of the inflation and partly because they hate Biden. Americans view their personal finances as good because their incomes have generally risen faster than the cost of living since the pre-Covid period. (Comparisons with early 2021 are meaningless, as the data was heavily distorted by Covid.)

PS. Biden’s economic policies are really bad, but for reasons that have nothing to do with the current state of the economy.

PPS. Trump has a 6-part plan to bring down inflation:

1. Favors NIMBY policies to prevent housing construction in the suburbs.

2. Expel all the illegal workers that pick our food and provide other key services.

3. Put heavy tariffs on imported food and other goods.

4. Have Medicare do less negotiation of drug prices.

5. Run super massive budget deficits.

6. Easy money.

What? You don’t think that will work?

People disliking the economy predicts presidential approval and re-election. I had not properly considered that causation runs in both directions. I knew about the partisan split, but for Biden the Democrats don’t like him either. The campaign likely changes that, so we should expect net economic sentiment to rise if things don’t get way worse.

Atlanta Fed finds that real wages remain down about 3%, now rising slightly.

The speculation is that this is largely due to compensation in the form of increased working from home. Working from home is now a luxury that you get in exchange for lower effective pay. It is definitely worth a 3% pay cut if you value it, but not everyone gets the benefit. If we estimate an additional 6% of workers are now fully remote and 20% have new hybrid arrangements, that implies a double digit pay cut for those workers to make this work out.

That is less obviously worthwhile and suggests a mystery remains to reconcile this with the seemingly tight labor market.

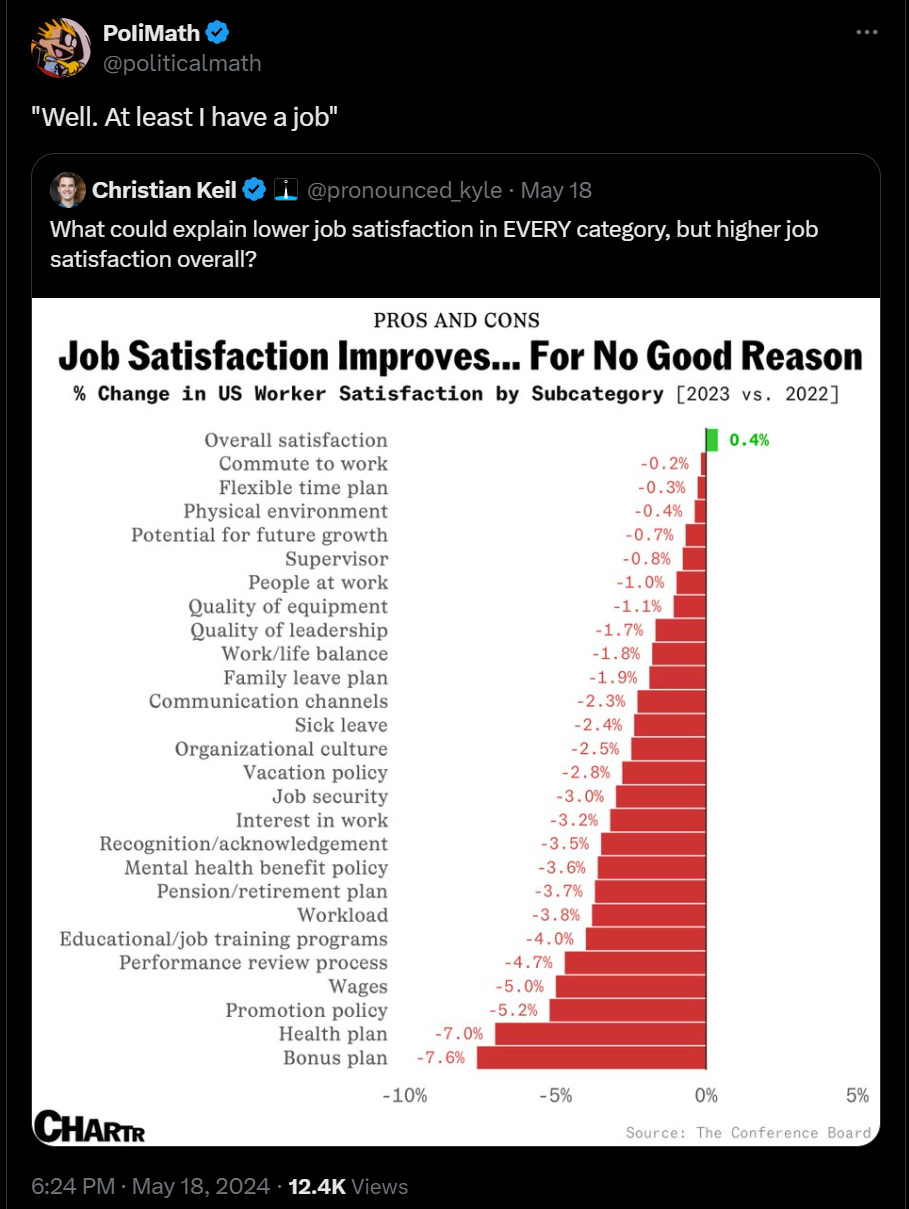

Another illustration of why people’s overall satisfaction with their situation does not tell you if times are good or people are happy with the times.

People answer largely by comparing their situation to expectations. So you can get some very strange distributions.

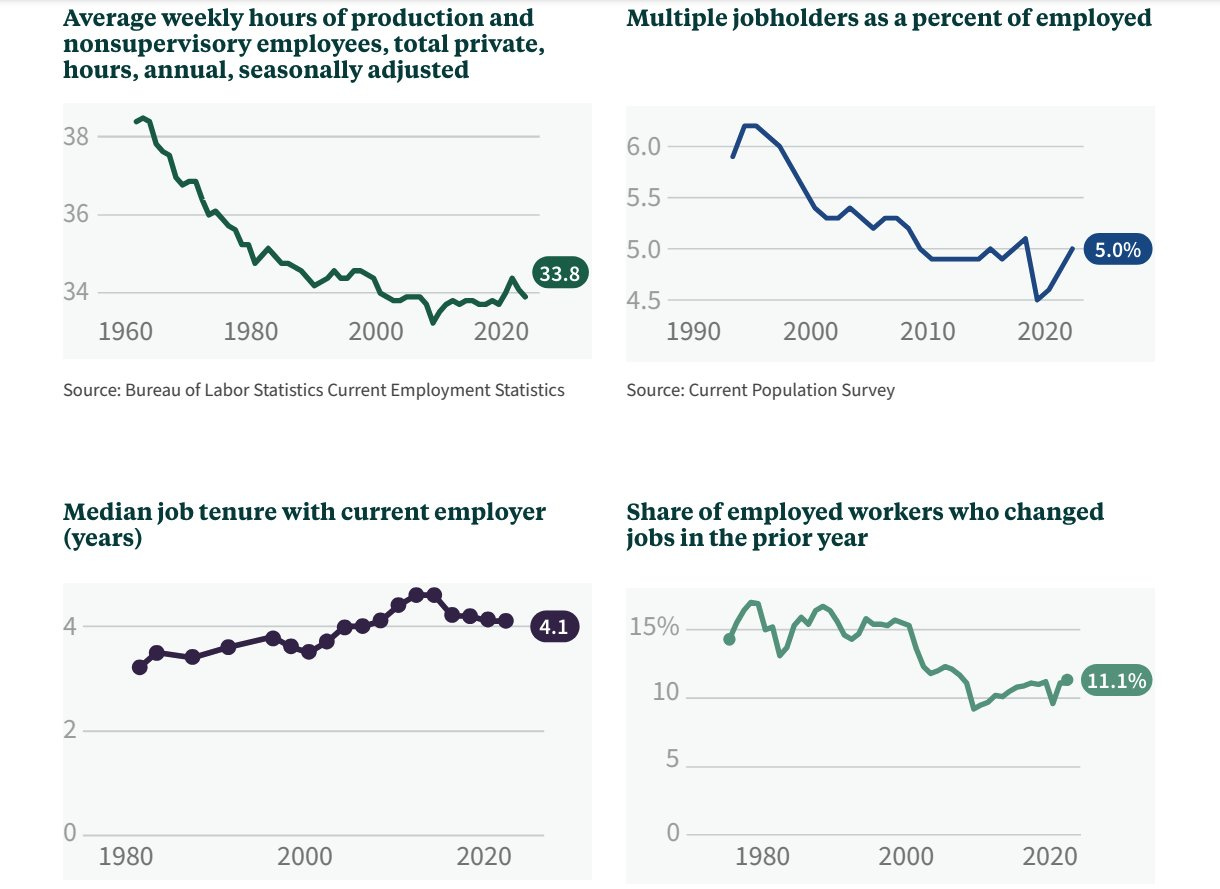

Connor O’Brien: In contrast to what you may hear about the gig-ification of work in America, via The American Worker Project:

-The average worker is working fewer hours

-Rates of 2+ jobs are down

-Typical job tenure is up

-People are changing jobs less frequently

As always, one must ask over what time frame.

The scare tactics on debt often focus on the word ‘unsustainable.’

Spectator Index: Bloomberg ran a million simulations to assess the ‘fragility’ of the US debt outlook, and in 88% of the simulations results showed the ‘debt-to-GDP ratio is on an unsustainable path’.

If you look, ‘unsustainable’ is defined to be ‘the debt-to-GDP ratio goes up.’ Yes, in some sense that is ‘unsustainable.’ It could still be sustained for quite a long time, even if real interest rates exceed real growth.

I am also confident that those simulations did not include plausible probability distributions for the impact of AI.

What does seem clearly true is that if America fails to experience substantial economic growth going forward and things are otherwise ‘normal,’ our levels of government spending under current public choice are indeed not sustainable, and if unadjusted would cause a crisis within our lifetimes. I do not think it is that likely that we will get this kind of normal scenario.

Yes, we could plausibly spend enough more than we could to get into avoidable trouble. Mostly this seems like

A new paper on immigration by Caiumi and Peri and its impact on native wages certain to change ones of minds.

Abstract: Using these estimates, we calculate that immigration, thanks to native-immigrant complementarity and college skill content of immigrants, had a positive and significant effect between +1.7% to +2.6% on wages of less educated native workers, over the period 2000-2019 and no significant wage effect on college educated natives. We also calculate a positive employment rate effect for most native workers. Even simulations for the most recent 2019-2022 period suggest small positive effects on wages of non-college natives and no significant crowding out effects on employment.

I believe the result, if you discount all the other various things that happen as the result of immigration.

Another immigration result was a National Academy of Sciences scenario analysis looking at impact over 75 years, concluding the fiscal impact of immigration is overall positive but that it was negative for those without an education beyond high school. Now two new results, Colas and Sachs and Michael Clemens, note that the indirect effects including labor supply composition and increased capital usage are sufficient that the net fiscal impact is still positive for almost all immigrants. Tyler Cowen covers it here in Bloomberg.

I file both results under the standard ‘yes obviously but it is good to demonstrate this.’

With the caveat that they get this result by considering certain select secondary impacts of immigration, while not modeling others, such as shifts in political dynamics or the housing market.

No, I do not expect any of this to change people’s opinions on immigration’s impact on their wages or the deficit, or their political or policy preferences.

FDIC Chair Sheila Bair calls Sam Bankman-Fried ‘financially illiterate.’

Sheila Bair: #SBF was financial illiterate. He thought effective altruism meant he could rip people off, that it was OK to use new investor money to pay the old… Another reason why we need early financial education – to help kids understand money ethics, hopefully preventing future SBF’s.

Seth Burn: I am not sure “financial illiterate” is an apt description of a former Jane Street trader. SBF clearly understood that his actions were verboten. That’s why he lied about them. Someone who was financially illiterate would have made different statements.

That is… not what financial illiterate means. The fact that the FDIC chair thinks that ‘financial literacy’ is the issue at hand worries me. This is exactly a lot of why SBF considered ‘adults in the room’ to be useless to him. SBF was a thief and a fraud and he got caught, that does not mean he was confused about what he was doing. I mean, yes, there were the parts where he was too scatterbrained and overloaded and indifferent to care what was going on or give decisions more than a minute’s thought, but that wasn’t because he lacked an education.

Financial literacy can start early. Talk to your kids about common sense.

William Eden: I was chatting with an economist today who said even children have correct intuitions about certain concepts

Me: “what would happen if you gave a million dollars to everyone?”

11yo: “prices would rise?”

8yo: “chaos”

🤣

Everyone gets full credit.

I like this trick:

Jenny Chase: Some bad things about Switzerland: low tax rates and high salaries act as a brain drain on surrounding countries (hi). This is how a poor country has become a very rich one in less than a hundred years.

Rob Henderson: I like to imagine the Bizarro universe of opposites when I see tweets like this. “Some good things about Switzerland: high tax rates and low salaries motivate skilled citizens to flee (hi). This is how a rich country has become a very poor one in less than a hundred years.”

FTX customers to recover ‘all funds lost in collapse’ in terms of the at-the-time dollar values of their portfolios. They still took a big hit in several ways, but this is a better result than anyone expected for a while.

Noah Smith discusses the fall in status for economists, especially macroeconomists, and various complaints people have against economists. Mostly I think this is part of the general (and in many places well-earned and long coming, but also coming from a general unwillingness to accept ugly realities and take the best you can get) fall of respect for expertise and credentials?

Patrick McKenzie explains that there are many tax deductions or dodges that you can in practice take for small amounts, such as not paying on the cash back or frequent flyer miles on business credit cards and trips. In practice the IRS will not care in most cases. But if you scale things high enough, if you optimize for the deduction hard enough, then it is worth the IRS’s time to have a problem with this. A lot of tax law seems to be, essentially, ‘write down whatever you want within reason but do not push it.’

Seriously, charge more. Plagiarism checker sold for eight figures. It has a free plan and a $10/month plan. Buyer adds a $30/month plan and a $100/month plan. Revenue doubles.

Stripe announces it will accept stablecoin payments this summer.

Plasma donations are way more impactful than I would have expected. For the doners, that is, not those who need plasma.

Tyler Cowen (from a St. Louis Fed study via Ken Lewis):

-

The typical plasma donor was younger than 35, did not hold a bachelor’s degree, earned a lower income and had a lower credit score than most Americans. Donors sold plasma primarily to earn income to cover day-to-day expenses or emergencies.

-

When a plasma center opened in a community, there were fewer inquiries to installment or payday lenders. Inquires fell most among young (age 35 or younger) would-be borrowers.

-

Four years after a plasma center opened, young people in the area were 13.1% and 15.7% less likely to apply for a payday and installment loan, respectively.

-

Similarly, the probability of having a payday loan declined by 18% among young would-be borrowers in the community.

-

That’s an effect on payday loan borrowing roughly equivalent to a $1 increase in the state minimum hourly wage.

That’s a huge decline in turning to very expensive alternative emergency funding mechanisms. Read that last line again.

Plasma donation actually pays pretty decently. You can do it twice a week for $30-$50 a pop. No, it is not ideal if the poor are falling back on that to avoid payday loans, but it seems way better than actually falling back on payday loans. Which in turn is often better than actively running out of money, although I think this is less obvious than economists typically assume it is because behaviors adjust to the optionality.

NPR reports supermarkets including Walmart are getting ready to offer fully dynamic pricing, adjusting ice cream and water upwards when it is hot, products close to expiration down, all in real time. I am here to warn those supermarkets: Don’t. If you raise prices on ice cream when it gets hot, your customers will absolutely revolt and crucify you, and this will dominate efficiency gains and revenue extraction. Even more than that, people need price consistency. Sales are fun opportunities, by all means do those and rotate and customize them more, but that is where it stops. If I have to confirm the price of everything each time I visit, I’m going to find another store.

Real ‘and your plan is to blackmail him’ energy on this one.

Joshua Wright: Ok now I went and actually read the Sen Warren grocery legislation press release. And I found this!?

“the bill requires public companies to transparently disclose and explain changes in their cost of goods sold, gross margins, and pricing strategies in their quarterly SEC filings.”

Really?

So let me get this straight — we’re going to get a bunch of competing firms in the food industry. Let’s call them rivals.

Sen Warren: Yup. Giant corporations. Evil. Bad.

And then we will have them publish how they are going to price in the future so all their rivals can see it?

Sen Warren: Yup. Transparency. Truthiness. Good.

And what do we expect to happen from forcing publication of future prices so that rivals can anticipate and coordinate strategic decisions?

Senator Warren: Prices will go …. Down.

You’ve got to be kidding me.

Brought to you by the geniuses that want to expand Robinson-Patman enforcement and chill discounts.

The Antitrust Paradox returns.

That is to say nothing of the practical considerations of having to ‘disclose and explain’ changes in cost of goods sold, gross margins and pricing strategies on a quarterly basis.

Never reason from a price change, attempt number quite a lot from Scott Sumner. Somehow, the exact timing and wording of this one sunk in for me, substantially more than previous efforts already had. This in particular:

Perhaps the following analogy would be useful: How do rising oil prices affect consumption, other things equal? That’s not even a question. Other things equal, oil prices never change. If oil prices rise due to reduced supply, then consumption falls. If oil prices rise because of increased demand, then consumption rises. But other things equal? What does that even mean?

My brain wanted to roll its eyes and say ‘yes, yes, Scott, we all get it, but still, what if the price did change anyway?’

And then I went through several cycles of ‘no, wait, that actually does not make any sense, the price will not change unless you change something else to make it change.’

You can do that via government fiat or monopoly decision if you want, but that too has a story that tells you what will then happen.

Would it have been wise to short DJT, Donald Trump Media?

I do not know. Certainly we all thought about it. But of course that is a hint. There was no rule saying the price had to come down quickly, or that it could not first go up quite a lot. And the borrow cost was something like 400% annualized.

Joe Weisenthal (April 15): Trump’s media company has now plunged 66% since its peak in late March. (Now need to go back and find all the savvy people on fintwit who said it was insane to short a stock like this).

Lake Cornelia Research Management: Hedge Fund Situations: The “Art” of Shorting

I like @TheStalwart but this is a sophomoric take. Was the $DJT overvalued? Of course. The issue with shorting is that you can only make 100%, but can lose an infinite amount. Further, at every price that you short, you can still make 100%; the only thing you give up by being “late” is the available dollar PNL to make. What we were getting at with our poll (results below), is that there is point where the risk / reward is the best…and it likely wasn’t over $50 – despite the poll results. Scaling into a short is the name of the game. The best shorts talk about “pressing” once the stock breaks trend.

The cost of borrow initially was over 400% for $DJT. That is a brutal vig to overcome. That is one of the other problems…you have to be right on timing too, because there is a ticking fee. Paul Enright, the former Viking PM now at Jain, walk through this on a podcast 2-3 years ago regarding $PTON on the short side. He noted all the people that carried the short for 3-6 months into the October “break” that bled theta vs. the guys that timed it right. Both made about 50% in total but the later group had a near infinite IRR. To be totally clear for the non-math people…shorting a $50 stock that goes to $30 has a worse return than shorting a $20 stock that goes to $10…and with a stock like $DJT, your conviction on the “meme bubble breaking” should be far higher at $20 than it was at $50.

In situations like this, and $GME $AMC etc you can have your cake and eat it too…you can wait for the meme guys to die and make more money after it is clear they are gone.

…

Look at options right now. You can buy the January $25 puts for $15…so you lose money if its over $10, and don’t even make 100% if it goes to zero…while risking a ton of capital. Would you do a risk/reversal and short the call to fund the put? Most brokers require that if you want to get size, so you would then have to sell a ~$50 call to get delta neutral.

Joe Weisenthal: Yeah this is totally fair. My tweet was sophomoric. It does seem like, regardless of a company’s valuation, or trajectory, or bubble-like characteristics, you probably hate yourself to some extent if you’re playing the short side.

I mean, I assumed when I saw it that Joe was joking.

I agree that the easiest play in situations like this is to wait until the party is clearly over, then get in on the way down. But even that is not so clear or safe. There is reason one cannot start another party.

One could say that the price of a DJT is not the real market. The real market is the price to short the stock, including all the risks that entails. That price is high, and plausibly efficient.

You still can beat the market, somewhat, by avoiding being on the wrong side of this trade. You do not want to be long DJT while its borrow costs are over 400% (unless you are at minimum collecting that borrow, and also have very good other reasons, by default this is a no just no).

In general, since it is expensive to short things, it it not even such a violation of EMH to say there are things you should know not to be long. When I buy individual stocks, I may not be that confident I can pick stocks to buy, but I am confident I can pick some of the stocks not to buy.

Tourism is like anything else. If you have too much of it, as Tyler Cowen reminds us, you should raise the price rather than lower the quality or restricting supply.

The weird thing about experiential goods like tourism is that people often get super mad about fees that go to the provider of the experience, while being happy to fork over ten or a hundred times as much so they can travel to the experience, and they can rearrange their lives to allow them the time away, and even to scalpers and travel agents.

This is backwards. You should be thrilled to support and reward those providing the actual value, not call them ‘greedy’ or accuse them of gouging. They are the ones producing the amazing value. Much better the value go to them than the scalpers and hotels and airlines.

Thus Japan has this exactly right. Raise the tourist price of the bullet train. Not only is this charging money, it is charging money in a relatively socially acceptable place.

Should we break up a big alcohol monopoly that is abusing its power, charging small retailers more than large ones? Tyler Cowen says no, because monopolies raise prices and reduce quantity, and for alcohol that is good. Like Tyler Cowen, I do not drink at all and think alcohol is best avoided by essentially everyone, and ideally taxes here would be higher but people wouldn’t go for it.

I still think we should either repeal or enforce the law.

Sam Bowman offers an interesting other argument, which is that the current system is highly conducive to a long tail of high quality product variety. In that context, if the lousy alcohol is more expensive, then that’s good for the niches.

The generalized Efficient Market Hypothesis, I hereby dub it the Efficient Company Hypothesis, is super duper false.

Patrick McKenzie: When I say some large companies just hate money, I am thinking of many, many experiences which are obviously not baked if you have seen them even once through a user’s eyes. This company does >$20B a year.

If you get a bill at that obscure provider Gmail it looks like:

Now I might not be as sharp as I used to be in conversation optimization, but I have a hypothesis or two for how one could increase CTR and payment rate for that email.

“Patrick you are neglecting the possibility that this was carefully chosen after thoroughly multi-arm banditing several candidates, where all the informative emails simply lost to the old intriguing mystery subject.”

Not ignoring it but p(that) is like 0.02% before I think much.

For starters almost nobody, not even the firms blessed with largest userbases and gigantic teams of stats PhDs with no brief other than to do testing, actually tests invoicing emails. Org/structural/tech reasons defeat attempts. Other places are more valuable to use bandwidth on.

Similarly, did you know Nvidia pays a $0.01/share dividend so funds that can only invest in companies paying dividends can hold shares? Yet other companies choose not to do this.

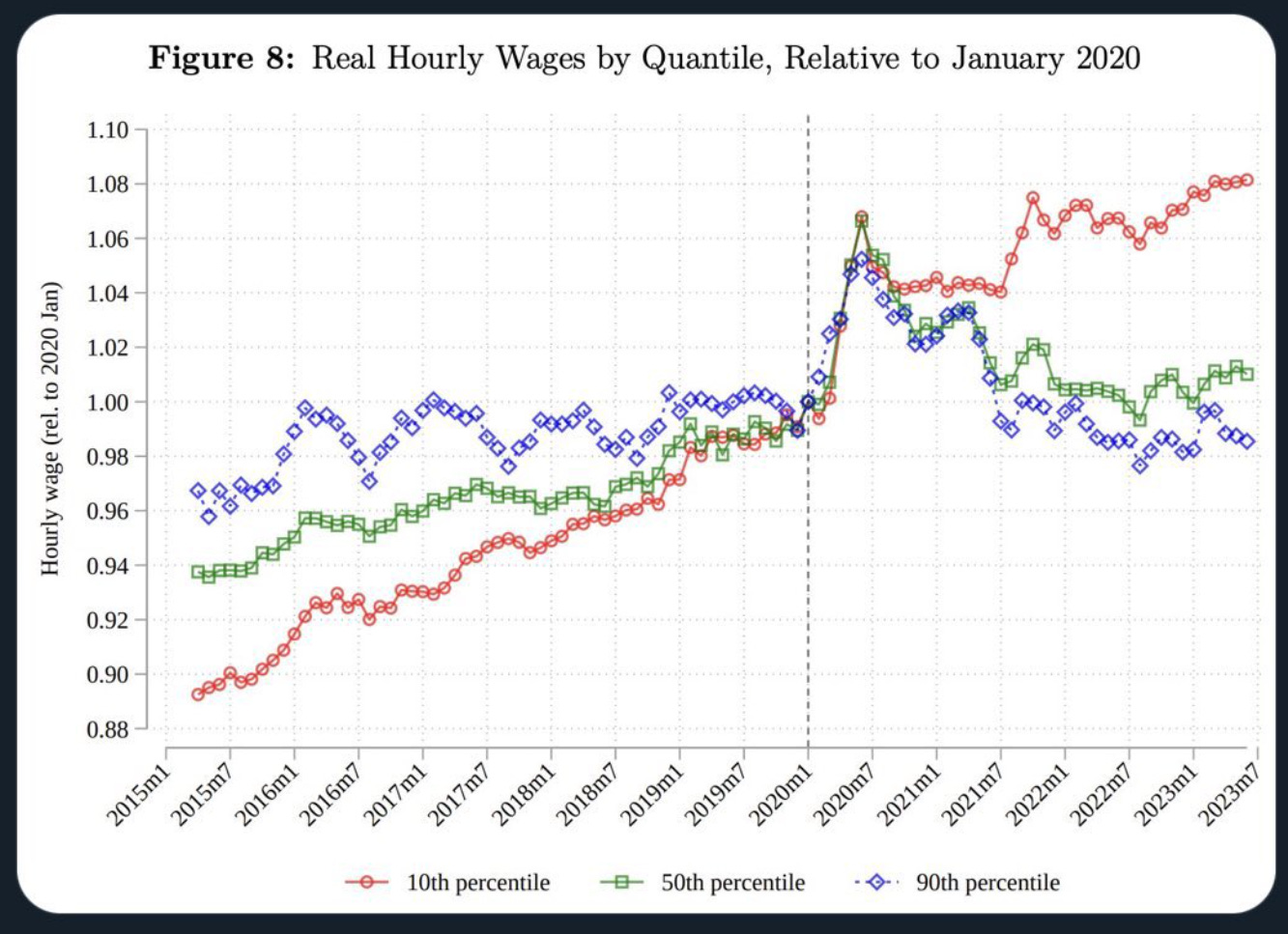

Marc Andreessen: Narrative violation! ‘Rapid relative wage growth at the bottom of the distribution counteraged nearly 40% of the four-decade increase in aggregate inequality.’

I felt a great disturbance in the force, as if millions of socialists cried out in terror.

Matthew Yglesias: Andreesen found @arindube’s paper about how the Biden economy is good, and decided that the point is it owns the libs.

Is that what this says? It is telling to conflate reduced inequality with good. This seems to show that median wages and 90th percentile wages are at roughly pre-pandemic levels, versus a small but real rise from 2015-2020. 10th percentile wages rose throughout, similarly under Biden versus the previous period, it looks like it returned to the trend line almost exactly.

Whereas what Andreesen is saying is that those complaining about how our horrible inequality is constantly getting worse are clearly wrong, with a huge ~18% jump over this period in relative wages.

That is distinct from the question of whether the Biden economy is good. Yglesias frames this as ‘things were very good in 2019 and are also very good now, except higher interest rates’ but higher interest rates impose big real costs. Is a 6% growth in real median wages over 5 years as measured (which as I have noted elsewhere I think overstates things in practice even without interest rates) a ‘very good’ economy? I mean, it’s fine, it is improvement over time, but it isn’t great.

Axios reports work weeks now down to starting on average on 4pm on Friday, versus 5pm as early as Q1 2021, in their survey data.

The central story here seems more about a radical decline in hours across the board? People are calling it a day earlier, at least in this population, and presumably working less, and that happened rather quickly. They speculate it is due to remote work less often bleeding into evenings.

Via Tyler Cowen via Kevin Lewis, companies that use explicit invocations of trust in their 10-K are less trustworthy. File under papers with results we all assumed but it is good that people took the time to put it in a formal journal so we can say Studies Show.

The way I learned this one was my father’s wise saying, ‘Never trust anybody who says ‘trust me.’’

We examine the relation between earnings information content and the use of trust words, such as “character,” “ethics,” and “honest,” in the MD&A section of 10-K. We find that earnings announcements of firms using trust words have lower information content than earnings announcements of firms that do not use trust words. We also find that the value relevance of earnings is lower for firms using trust words than those not using trust words. Further, firms using trust words are more likely to receive a comment letter from the SEC, pay higher audit fees, and have lower corporate social responsibility scores.

Overall, our results suggest that firms that use trust words in the 10-K are associated with negative outcomes, and trust words are an inverse measure of trust.

China is continuing down the path of an increasingly centrally planned economy. A CEO from the China Development Forum (CDF) reports via CNBC’s Michelle Caruso-Cabrera that confidence is very low and business continues to be terrible. Wealthy Chinese are selling their conspicuous trappings of wealth and trying to move money out of the country given how dangerous it is to be rich in China, and that Xi intends to double down on his economic strategy of favoring and focusing on state-owned enterprises. There also was not mention of China’s dire demographic time bomb.

Xi does not understand (unless he does and simply does not care?) that this never works and it will not work for him. Xi says the governing system of China is not going to change, but indeed it has changed, retreating from its previous compromises. And given this attitude, it is likely to change more in the same direction. It will not go well.

He also made various statements on US-China relations and Taiwan, including emphasizing avoiding the Thucydides trap and nuclear war at all costs. He is mad about Taiwan and our policy on semiconductors, but why shouldn’t he be?

Similarly, here is Graham Allison, who also points out Xi’s clear understanding of the need to play out this rivalry peacefully, and that there is room for prosperity for all.

Jamie Dimon reminds us that obviously we should re-enter the prior negotiated Trans-Pacific Partnership. If you think we have to ‘beat China’ and do not at least want to be in the TPP, I have no words.

Find a need and fill it.

Matthew Zeitlin: Your kid opens an HVAC business, my kid goes to business school and rolls up HVAC businesses.