Westinghouse is claiming a nuclear deal would see $80B of new reactors

On Tuesday, Westinghouse announced that it had reached an agreement with the Trump administration that would purportedly see $80 billion of new nuclear reactors built in the US. And the government indicated that it had finalized plans for a collaboration of GE Vernova and Hitachi to build additional reactors. Unfortunately, there are roughly zero details about the deal at the moment.

The agreements were apparently negotiated during President Trump’s trip to Japan. An announcement of those agreements indicates that “Japan and various Japanese companies” would invest “up to” $332 billion for energy infrastructure. This specifically mentioned Westinghouse, GE Vernova, and Hitachi. This promises the construction of both large AP1000 reactors and small modular nuclear reactors. The announcement then goes on to indicate that many other companies would also get a slice of that “up to $332 billion,” many for basic grid infrastructure.

So the total amount devoted to nuclear reactors is not specified in the announcement or anywhere else. As of the publication time, the Department of Energy has no information on the deal; Hitachi, GE Vernova, and the Hitachi/GE Vernova collaboration websites are also silent on it.

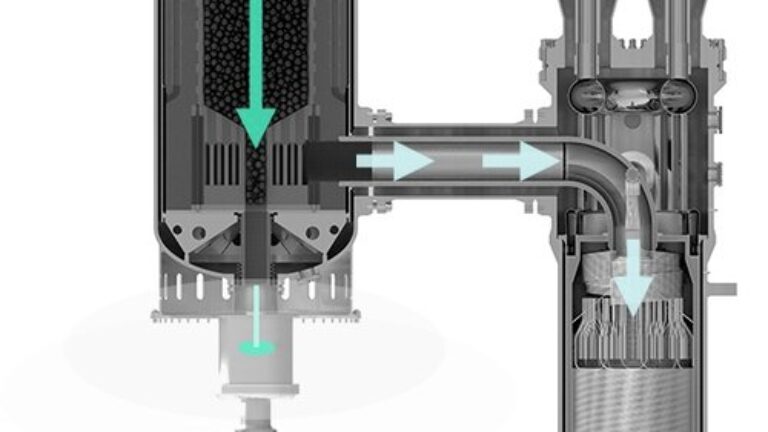

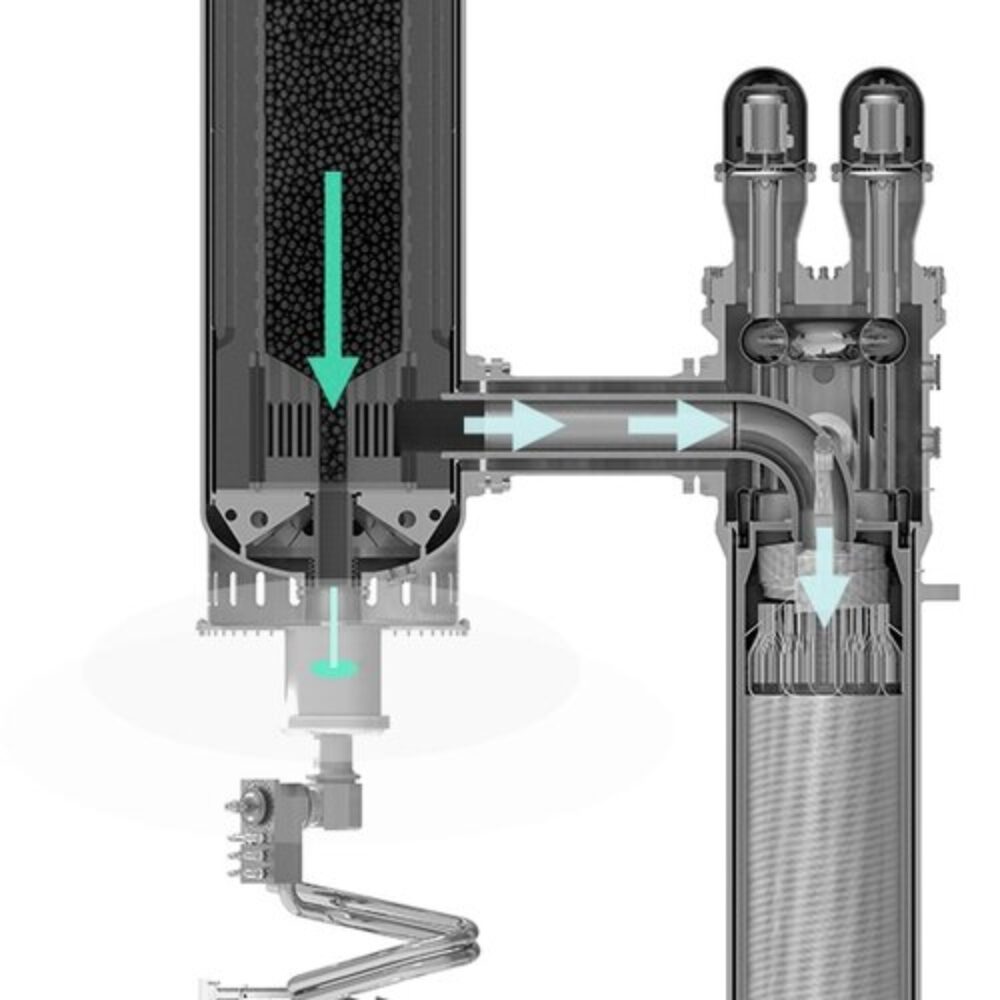

Meanwhile, Westinghouse claims that it will be involved in the construction of “at least $80 billion of new reactors,” a mix of AP1000 and AP300 (each named for the MW of capacity of the reactor/generator combination). The company claims that doing so will “reinvigorate the nuclear power industrial base.”

Westinghouse is claiming a nuclear deal would see $80B of new reactors Read More »