Mario Kart World’s $80 price isn’t that high, historically

We assembled data for those game baskets across 21 non-consecutive years, going back to 1982, then normalized the nominal prices to consistent February 2025 dollars using the Bureau of Labor Statistics CPI calculator. You can view all our data and sources in this Google Sheet.

The bad old days

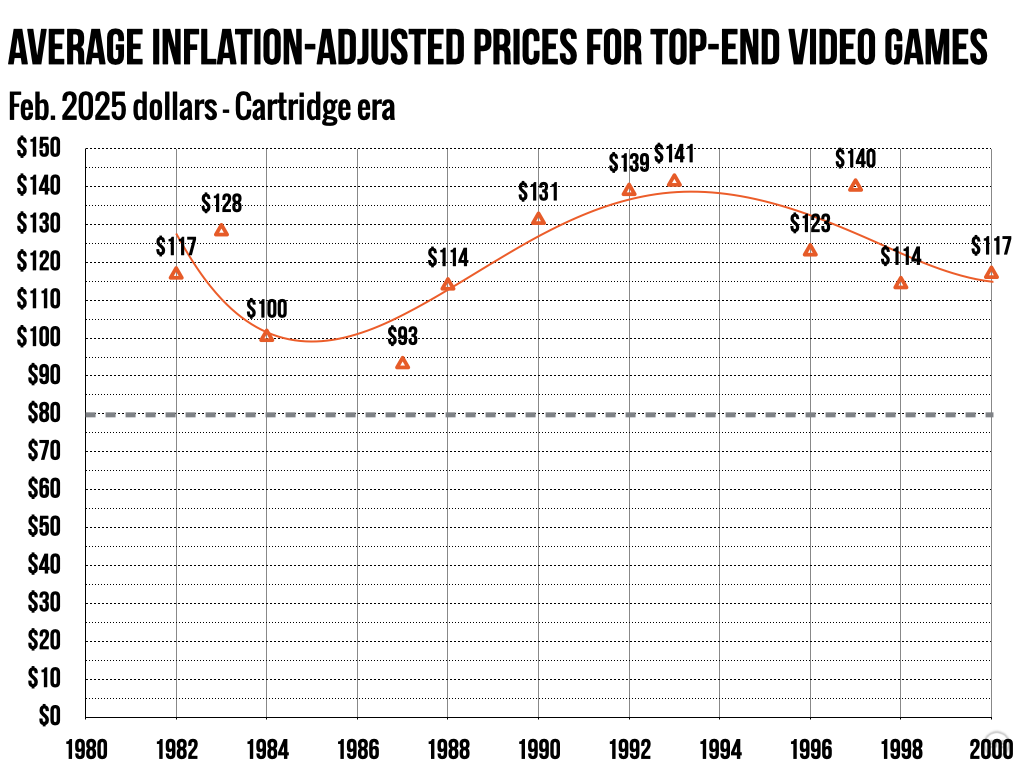

In purely nominal terms, the $30 to $40 retailers routinely charged for game cartridges in the 1980s seems like a relative bargain. Looking at the inflation-adjusted data, though, it’s easy to see how even an $80 game today would seem like a bargain to console gamers in the cartridge era.

Video game cartridges were just historically expensive, even compared to today’s top-end games. Credit: Kyle Orland / Ars Technica

New cartridge games in the 20th century routinely retailed for well over $100 in 2025 money, thanks to a combination of relatively high manufacturing costs and relatively low competition in the market. While you could often get older and/or used cartridges for much less than that in practice, must-have new games at the time often cost the equivalent of $140 or more in today’s money.

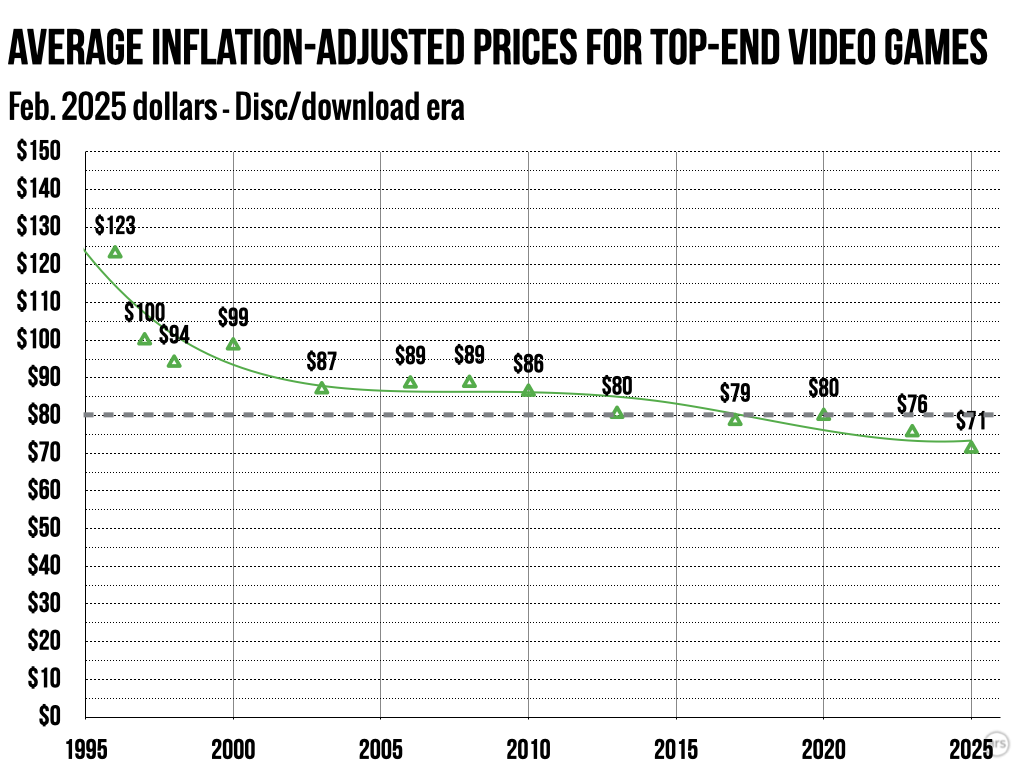

Pricing took a while to calm down once CD-based consoles were introduced in the late ’90s. By the beginning of the ’00s, though, nominal top-end game pricing had fallen to about $50, and only rose back to $60 by the end of the decade. Adjusting for inflation, however, those early 21st-century games were still demanding prices approaching $90 in 2025 dollars, well above the new $80 nominal price ceiling Mario Kart World is trying to establish.

Those $50 discs you remember from the early 21st century were worth a lot more after you adjust for inflation. Credit: Kyle Orland / Ars Technica

In the 2010s, inflation started eating into the value of gaming’s de facto $60 price ceiling, which remained remarkably consistent throughout the decade. Adjusted for inflation, the nominal average pricing we found for our game “baskets” in 2013, 2017, and 2020 ended up almost precisely equivalent to $80 in constant 2025 dollars.

Is this just what things cost now?

While the jump to an $80 price might seem sudden, the post-COVID jump in inflation makes it almost inevitable. After decades of annual inflation rates in the 2 to 3 percent range, the Consumer Price Index jumped 4.7 percent in 2021 and a whopping 8 percent in 2022. In the years since, annual price increases still haven’t gotten below the 3 percent level that was once seen as “high.”

Mario Kart World’s $80 price isn’t that high, historically Read More »