“So tired”: Disney+, Hulu, ESPN+ prices increase by up to 25 percent in October

The cycle continues —

Not even ad tiers are safe as Disney looks to coax people into bundle packages.

Enlarge / A scene from the new season of Doctor Who, which is streaming on Disney+.

Disney+

Disney+, Hulu, and ESPN+ will get more expensive as of October 17, whether users have a subscription with or without ads. After most recently jacking up streaming prices in October 2023, The Walt Disney Company is raising subscription fees by as much as 25 percent, depending on the streaming service and plan.

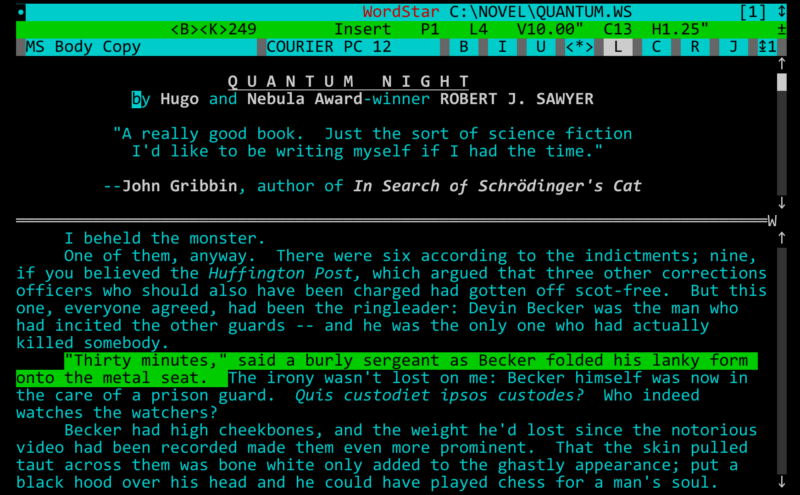

Here’s how pricing will look in October compared to now:

| Now | As of October 17 | |

|---|---|---|

| Disney+ with ads | $8/month | $10/month |

| Disney+ without ads | $14/month $140/year |

$16/month $160/year |

| Hulu with ads | $8/year $80/year |

$10/month $100/year |

| Hulu without ads | $18/month | $19/month |

| Hulu and Live TV with ads | $77/month | $83/month |

| Hulu and Live TV without ads | $90/month | $96/month |

| Disney+ and Hulu with ads | $10/month | $11/month |

| Disney+ and Hulu without ads | $20/month | No change |

| ESPN+ | $11/month $110/year |

$12/month $120/year |

| Disney+, Hulu, and ESPN+ with ads | $15 | No change |

| Disney+, Hulu, and ESPN+ without ads | $25 | No change |

Disney didn’t announce any pricing changes for the bundle that contains Disney+, sister streaming service Hulu, and Warner Bros. Discovery’s rival streaming platform, Max.

Based on the updated pricing, Disney is seemingly trying to coax people to sign up for one of its streaming bundles, which combine multiple services for a lower price than if the services were each subscribed to individually. Streaming companies have been trying to use bundles to deter people from frequently canceling their streaming subscriptions. But as we’ve written before, streaming bundles don’t address subscribers’ complaints around incessant price hikes, content quality, confusing packages, or features.

Another price hike

One of the biggest problems that streaming subscribers, especially long-term ones, are facing is ever-rising prices. Disney already increased prices in October 2023, meaning Disney+, Hulu, and ESPN+ are facing their second price hikes in about a year.

Early reactions online, including on forums like Reddit, show people dissatisfied with streaming price hikes that don’t seem to align with the quality of content available. For example, Reddit user Montysucker wrote: “easy[,] cancel now,” adding:

“The enshittification of media in the last few years is insane and it’s wild how seemingly no one cares anymore about making something that is actually enjoyable to watch and not their egotistic[al] pipe dream.”

Of course, many expressed being overwhelmed with continuing to see streaming prices rise, as Slow_Investment_2211 wrote:

On October 12, 2023, as Variety summarized, Disney+ without ads went up by 27 percent, from $11 to $14 per month. Hulu without ads went up 20 percent ($15 to $18/month). Hulu with Live packages each also increased by $7 at the time, while ESPN+ pricing increased by $1.

Disney paired the price hike announcement with the revealing of new upcoming features for Disney+. However, the new linear channels are little comfort for people who don’t use Disney+.

The new channels will be ABC News Live, which Disney+ users can access on September 4, and channels “focused on preschool content, featuring TV series and shorts available on Disney+.” Disney+ will also get four more channels (or as Disney’s calling them, playlists) that show: 1) “Seasonal Content” from Disney+; 2) “Epic Stories” from big franchises like Marvel and Star Wars; 3) “Throwbacks” with “nostalgic pop culture”; and 4) “Real Life” documentaries.

It’s possible that Disney will introduce more channels to appeal to more users. But with all the price hikes that streaming subscribers have endured over the past few years, many would prefer avoiding price bumps that are partially for extra channels that they may never watch. Charging for unwanted content in media packages that are already priced questionably is reminiscent of cable, something that streaming was initially supposed to replace, not replicate.

Subscribers to Disney’s trio of streaming services will be unlikely to be alone in facing price hikes for long; analysts suspect Netflix pricing will also increase this year.

“So tired”: Disney+, Hulu, ESPN+ prices increase by up to 25 percent in October Read More »