Oracle shares slide on $15B increase in data center spending

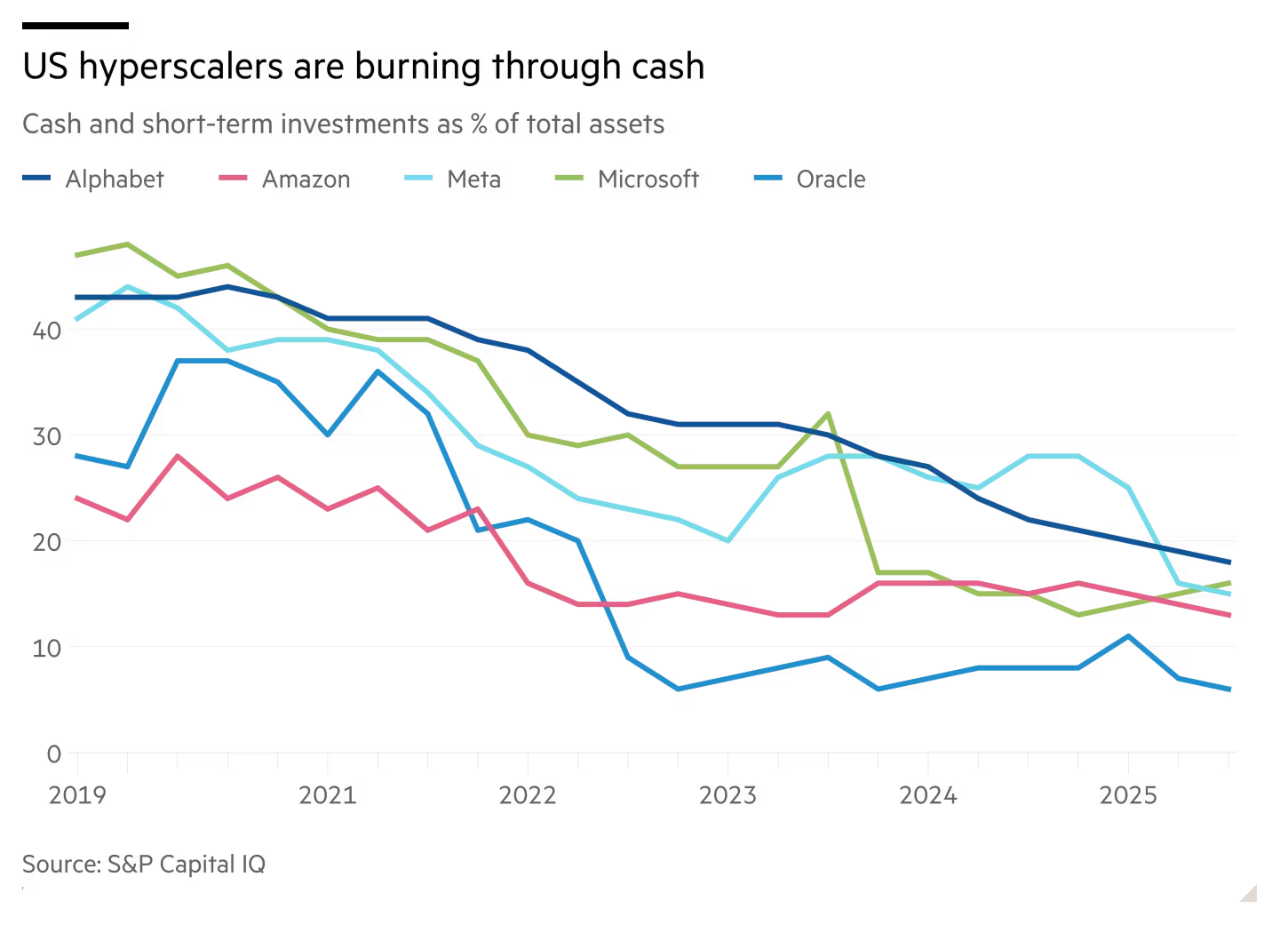

Oracle’s Big Tech rivals such as Amazon, Microsoft, and Google have helped reassure investors about their large capital investments by posting strong earnings from their vast cloud units.

But in the last quarter, Oracle’s cloud infrastructure business, which includes its data centers, posted worse than expected revenues of $4.1 billion. Ellison’s company is also relying more heavily on debt to fuel its expansion.

Net income rose to $6.1 billion in the quarter, boosted by a $2.7 billion pre-tax gain from the sale of semiconductor company Ampere to SoftBank.

The company added an additional 400 MW of data center capacity in the quarter, Magouyrk told investors. Construction was on track at its large data center cluster in Abilene, Texas, which is being built for OpenAI, he added.

Magouyrk, who took over from Safra Catz in September, said there was ample demand from other clients for Oracle’s data centers if OpenAI did not take up the full amount it had contracted for.

“We have a customer base with a lot of demand such that whenever we find ourselves [with] capacity that’s not being used, it very quickly gets allocated,” he said.

Co-founded by Ellison as a business software provider, Oracle was slow to pivot to cloud computing. The billionaire remains chair and its largest shareholder.

Investors and analysts have raised concerns in recent months about the upfront spending required by Oracle to honor its AI infrastructure contracts. Moody’s in September flagged the company’s reliance on a small number of large customers such as OpenAI.

Morgan Stanley forecasts that Oracle’s net debt will soar to about $290 billion by 2028. The company sold $18 billion of bonds in September and is in talks to raise $38 billion in debt financing through a number of US banks.

Brent Thill, an analyst at Jefferies, said Oracle’s software business—which generated $5.9 billion in the quarter—provided some buffer amid accelerated spending. “But the timing mismatch between upfront capex and delayed monetization creates near-term pressure.”

Doug Kehring, principal financial officer, said the company was renting capacity from data center specialists to reduce its direct borrowing.

The debt to build the Abilene site was raised by start-up Crusoe and investment group Blue Owl Capital, and Oracle has signed a 15-year lease for the site.

“Oracle does not pay for these leases until the completed data centers… are delivered to us,” Kehring said, adding that the company was “committed to maintaining our investment-grade debt ratings.”

© 2025 The Financial Times Ltd. All rights reserved. Not to be redistributed, copied, or modified in any way.

Oracle shares slide on $15B increase in data center spending Read More »