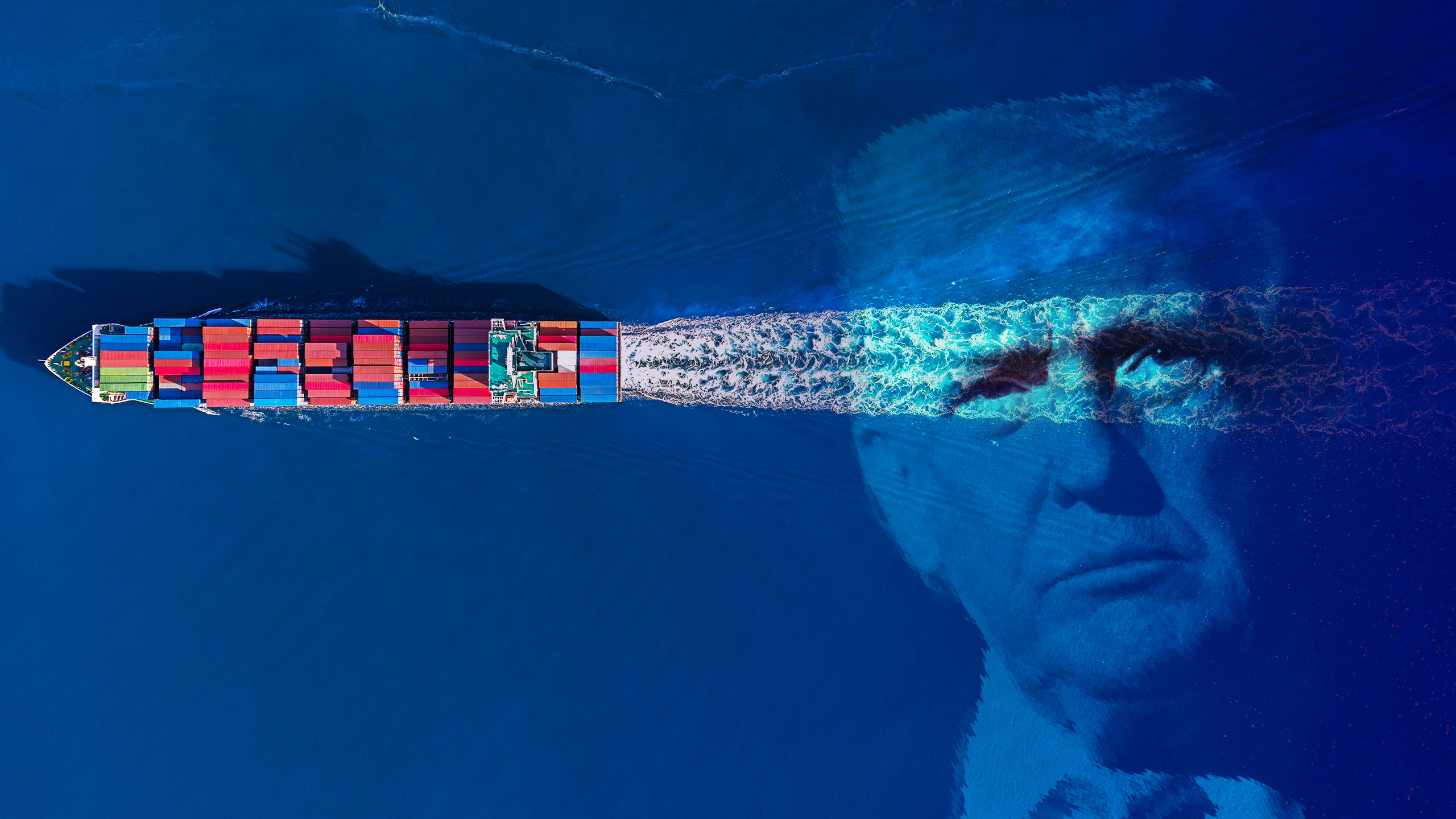

Supreme Court blocks Trump’s emergency tariffs, billions in refunds may be owed

Economists estimated more than $175 billion may need to be refunded.

The Supreme Court ruled Friday that Donald Trump was not authorized to implement emergency tariffs to ostensibly block illegal drug flows and offset trade deficits.

It’s not immediately clear what the ruling may mean for businesses that paid various “reciprocal” tariffs that Trump changed frequently, raising and lowering rates at will during tense negotiations with the United States’ biggest trade partners.

Divided 6-3, Supreme Court justices remanded the cases to lower courts, concluding that the International Emergency Economic Powers Act (IEEPA) does not give Trump power to impose tariffs.

Chief Justice John Roberts wrote the opinion and was joined by Justices Neil Gorsuch, Amy Coney Barrett, Elena Kagan, Sonia Sotomayor, and Ketanji Brown Jackson. They concluded that Trump could not exclusively rely on IEEPA to impose tariffs “of unlimited amount and duration, on any product from any country” during peacetime.

Only Congress has the power of the purse, Roberts wrote, and the few exceptions to that are bound by “explicit terms and subject to strict limits.”

“Against that backdrop of clear and limited delegations, the Government reads IEEPA to give the President power to unilaterally impose unbounded tariffs and change them at will,” Roberts wrote. “That view would represent a transformative expansion of the President’s authority over tariff policy. It is also telling that in IEEPA’s half century of existence, no President has invoked the statute to impose any tariffs, let alone tariffs of this magnitude and scope. That ‘lack of historical precedent,’ coupled with ‘the breadth of authority’ that the President now claims, suggests that the tariffs extend beyond the President’s ‘legitimate reach.’”

Back in November, analysts suggested that the Supreme Court ruling against Trump could force the government to issue refunds of up to $1 trillion. This morning, a new estimate from economists reduced that number, Reuters reported, estimating that more than $175 billion could be “at risk of having to be refunded.”

Ruling disrupts Trump plan to collect $900 billion

Trump lost primarily because IEEPA does not explicitly reference “tariffs” or “duties,” instead only giving Trump power to “regulate” “importation”—the two words in the statute that Trump tried to argue showed that Congress clearly authorized his power to impose tariffs.

But the court did not agree that Congress intended to give the president “the independent power to impose tariffs on imports from any country, of any product, at any rate, for any amount of time,” Roberts wrote. “Those words cannot bear such weight,” particularly in peacetime. “The United States, after all, is not at war with every nation in the world.”

Specifically, Trump failed to “identify any statute in which the power to regulate includes the power to tax,” Roberts wrote. And the majority of justices remained “skeptical” that in “IEEPA alone,” Congress intended to hide “a delegation of its birth-right power to tax within the quotidian power to ‘regulate.’”

“A contrary reading would render IEEPA partly unconstitutional,” Roberts wrote.

According to the majority, siding with Trump would free the president to “issue a dizzying array of modifications” to tariffs at will, “unconstrained by the significant procedural limitations in other tariff statutes.” The only check to that unprecedented power grab, the court suggested, would be a “veto-proof majority in Congress.”

Trump has yet to comment on the ruling. Ahead of it, he claimed the tariffs were “common sense,” NBC News reported. Speaking at a steel manufacturing factory in northwest Georgia, Trump claimed that IEEPA tariffs were projected to bring in $900 billion “next year.” Not only could he now be forced to refund tariffs, but the Supreme Court ruling could also undo trade deals in which Trump used so-called reciprocal tariffs as leverage. Undoing tariffs will likely be a “mess,” Barrett said last year.

“Until now, no President has read IEEPA to confer such power,” Roberts wrote, while noting that the court claims “no special competence in matters of economics or foreign affairs.”

Gorsuch seems to troll Trump

In a concurring opinion, Gorsuch slammed Trump as trying to expand the president’s authority in a way that would make it hard for Congress to ever retrieve lost powers. He claimed that Trump was seeking to secure a path forward where any president could declare a national emergency—a decision that would be “unreviewable”—to justify imposing “tariffs on nearly any goods he wishes, in any amount he wishes, based on emergencies he himself has declared.”

“Just ask yourself: What President would willingly give up that kind of power?” Gorsuch wrote.

Gorsuch further questioned if Trump was “seeking to exploit questionable statutory language to aggrandize his own power.” And he warned that accepting the dissenting view would allow Trump to randomly impose tariffs as low as 1 percent or as high as 1,000,000 percent on any product or country he wanted at any time.

Gorsuch criticized justices with dissenting views, who disagreed that Congress’ intent in the statute was unclear and defended Trump’s claim that “IEEPA provides the clear statement needed to sustain the President’s tariffs.” Those justices argued that presidents have long been granted authority to impose tariffs and accused the majority of putting a “thumb on the scale” by requiring a strict reading of the statute. Instead, they argued for a special exception requiring a more general interpretation of statutes whenever presidents seek to regulate matters of foreign affairs.

If that view was accepted, Gorsuch warned, presidents could seize even more power from Congress. Many other legislative powers “could be passed wholesale to the executive branch in a few loose statutory terms, no matter what domestic ramifications might follow. And, as we have seen, Congress would often find these powers nearly impossible to retrieve.”

As a final note, Gorsuch took some time to sympathize with Trump supporters:

For those who think it important for the Nation to impose more tariffs, I understand that today’s decision will be disappointing. All I can offer them is that most major decisions affecting the rights and responsibilities of the American people (including the duty to pay taxes and tariffs) are funneled through the legislative process for a reason. Yes, legislating can be hard and take time. And, yes, it can be tempting to bypass Congress when some pressing problem arises. But the deliberative nature of the legislative process was the whole point of its design. Through that process, the Nation can tap the combined wisdom of the people’s elected representatives, not just that of one faction or man. There, deliberation tempers impulse, and compromise hammers disagreements into workable solutions. And because laws must earn such broad support to survive the legislative process, they tend to endure, allowing ordinary people to plan their lives in ways they cannot when the rules shift from day to day.

Kavanaugh questions other Trump tariff authority

Under IEEPA, the majority ruled, Trump has the power to “impose penalties, restrictions, or controls on foreign commerce,” Barrett wrote. But he does not have the power to impose emergency tariffs, unless Congress updates laws to explicitly grant such authority.

In his dissent, justice Brett Kavanaugh insisted that it should not be up to courts to settle these “policy debates.” He defended Trump’s view that IEEPA granting power to “regulate” “importation” generally included tariffs, while arguing that Trump wasn’t seeking to expand his presidential authority at all. Many feared that the more conservative Supreme Court would side with Trump, and Kavanaugh’s opinion offered a peek at what that alternate reality could have looked like.

“Importantly, IEEPA’s authorization for the President to impose tariffs did not grant the President any new substantive power,” Kavanaugh wrote. Instead, “IEEPA merely allows the President to impose tariffs somewhat more efficiently to deal with foreign threats during national emergencies.” He further claimed it was an “odd distinction” that the majority would interpret IEEPA as giving Trump authority to “block all imports from China” but not to “order even a $1 tariff on goods imported from China.”

Downplaying the ruling’s significance, Kavanaugh echoed the Trump administration’s claims that the Supreme Court ruling won’t really affect Trump’s key policy of imposing tariffs to renegotiate trade deals or address other concerns.

“The decision might not substantially constrain a President’s ability to order tariffs going forward,” Kavanugh wrote, pointing to “numerous other federal statutes” that “authorize the President to impose tariffs.”

However, a footnote in the majority’s opinion emphasized that all of the options that Kavanaugh cited “contain various combinations of procedural prerequisites, required agency determinations, and limits on the duration, amount, and scope of the tariffs they authorize.” It was precisely constraints like those that Trump’s broad reading of IEEPA lacked, the majority found.

Kavanaugh acknowledged that the ruling would stop Trump from imposing tariffs at will, writing that other statutes require “a few additional procedural steps that IEEPA, as an emergency statute, does not require.”

Winding down his arguments, Kavanaugh joined Trump administration officials in groaning that the “United States may be required to refund billions of dollars to importers who paid the IEEPA tariffs, even though some importers may have already passed on costs to consumers or others.”

Kavanaugh makes a frequently overlooked point there in this argument, which is that IEEPA tariffs may have harmed consumers without any immediate remedy. It seems unlikely that consumers will get any relief in the short-term, no matter what remedies the Supreme Court’s ruling triggers. For businesses, the primary relief will likely not be from refunds but from the small amount of certainty they will have going forward that tariffs won’t be suddenly changed or imposed overnight.

Kavanaugh conceded that Trump’s tariffs “may or may not be wise policy.” But he fretted that Trump’s trade deals “worth trillions of dollars” could be undone by the ruling, while claiming the ruling has only generated more uncertainty on a global scale, including with America’s biggest rival, China.

Interestingly, Kavanaugh also suggested that the ruling may put at legal risk the reading of another statute that Trump will likely rely on more heavily moving forward to impose tariffs.

“One might think that the Court’s opinion would also mean that tariffs cannot be imposed under Section 232, which authorizes the President to ‘adjust the imports,’” Kavanaugh suggested.

This story was updated to include views from Gorsuch and Kavanaugh.

Supreme Court blocks Trump’s emergency tariffs, billions in refunds may be owed Read More »