TCL TVs will use films made with generative AI to push targeted ads

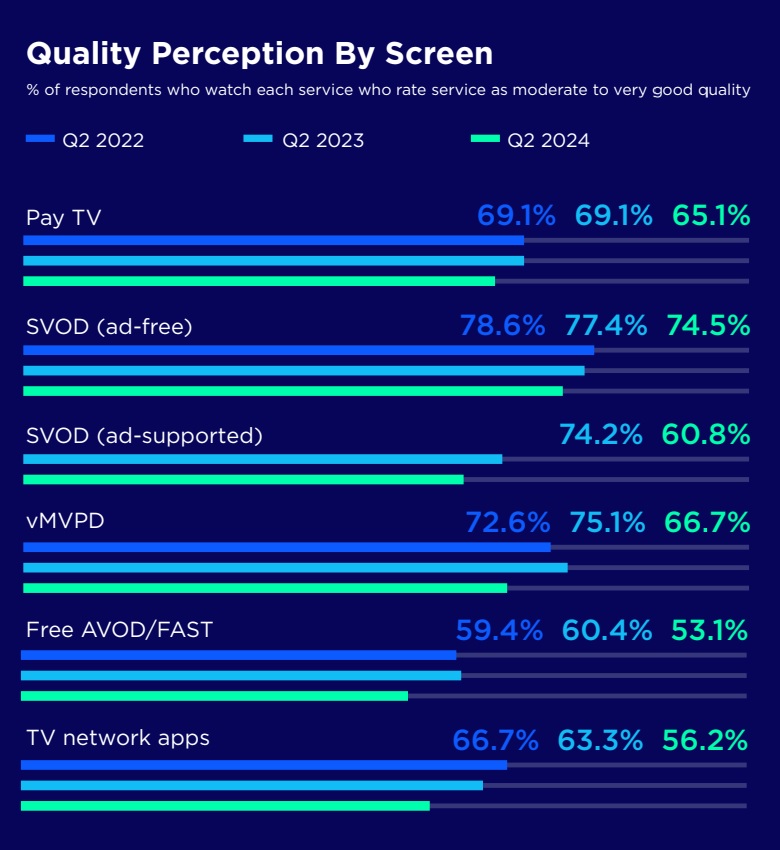

Advertising has become a focal point of TV software. We’re seeing companies that sell TV sets be increasingly interested in leveraging TV operating systems (OSes) for ads and tracking. This has led to bold new strategies, like an adtech firm launching a TV OS and ads on TV screensavers.

With new short films set to debut on its free streaming service tomorrow, TV-maker TCL is positing a new approach to monetizing TV owners and to film and TV production that sees reduced costs through reliance on generative AI and targeted ads.

TCL’s five short films are part of a company initiative to get people more accustomed to movies and TV shows made with generative AI. The movies will “be promoted and featured prominently on” TCL’s free ad-supported streaming television (FAST) service, TCLtv+, TCL announced in November. TCLtv+has hundreds of FAST channels and comes on TCL-brand TVs using various OSes, including Google TV and Roku OS.

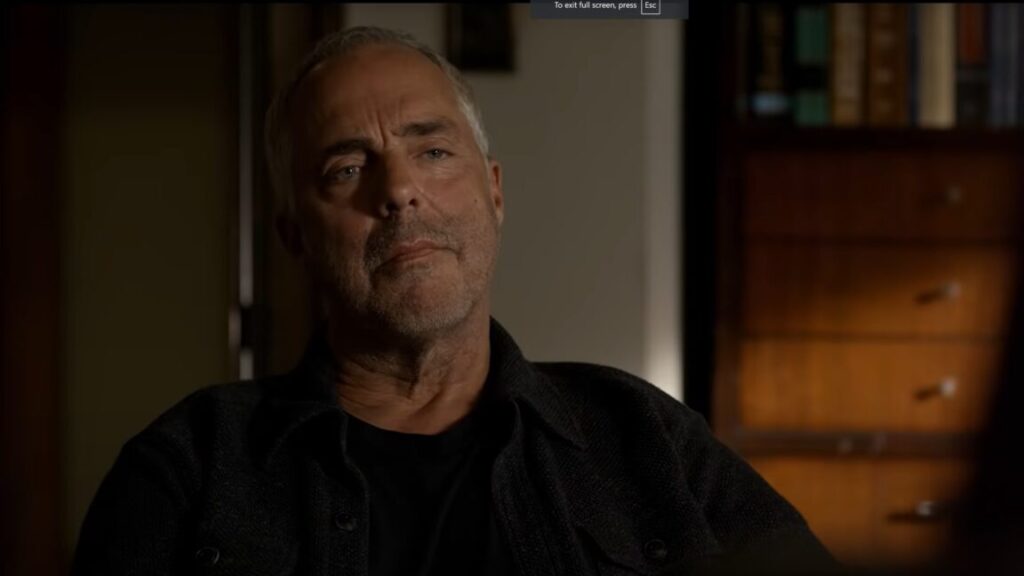

Some of the movies have real actors. You may even recognize some, (like Kellita Smith, who played Bernie Mac’s wife, Wanda, on The Bernie Mac Show). Others feature characters made through generative AI. All the films use generative AI for special effects and/or animations and took 12 weeks to make, 404 Media, which attended a screening of the movies, reported today. AI tools used include ComfyUI, Nuke, and Runway, 404 reported. However, all of the TCL short movies were written, directed, and scored by real humans (again, including by people you may be familiar with). At the screening, Chris Regina, TCL’s chief content officer for North America, told attendees that “over 50 animators, editors, effects artists, professional researchers, [and] scientists” worked on the movies.

I’ve shared the movies below for you to judge for yourself, but as a spoiler, you can imagine the quality of short films made to promote a service that was created for targeted ads and that use generative AI for fast, affordable content creation. AI-generated videos are expected to improve, but it’s yet to be seen if a TV brand like TCL will commit to finding the best and most natural ways to use generative AI for video production. Currently, TCL’s movies demonstrate the limits of AI-generated video, such as odd background imagery and heavy use of narration that can distract from badly synced audio.

TCL TVs will use films made with generative AI to push targeted ads Read More »