Tech brands are forcing AI into your gadgets—whether you asked for it or not

Enlarge / Tech brands love hollering about the purported thrills of AI these days.

Logitech announced a new mouse last week. A company rep reached out to inform Ars of Logitech’s “newest wireless mouse.” The gadget’s product page reads the same as of this writing.

I’ve had good experience with Logitech mice, especially wireless ones, one of which I’m using now. So I was keen to learn what Logitech might have done to improve on its previous wireless mouse designs. A quieter click? A new shape to better accommodate my overworked right hand? Multiple onboard profiles in a business-ready design?

I was disappointed to learn that the most distinct feature of the Logitech Signature AI Edition M750 is a button located south of the scroll wheel. This button is preprogrammed to launch the ChatGPT prompt builder, which Logitech recently added to its peripherals configuration app Options+.

That’s pretty much it.

Beyond that, the M750 looks just like the Logitech Signature M650, which came out in January 2022. Also, the new mouse’s forward button (on the left side of the mouse) is preprogrammed to launch Windows or macOS dictation, and the back button opens ChatGPT within Options+. As of this writing, the new mouse’s MSRP is $10 higher ($50) than the M650’s.

-

The new M750 (pictured) is 4.26×2.4×1.52 inches and 3.57 ounces.

Logitech

-

The M650 (pictured) comes in 3 sizes. The medium size is 4.26×2.4×1.52 inches and 3.58 ounces.

Logitech

I asked Logitech about the M750 appearing to be the M650 but with an extra button, and a spokesperson responded by saying:

M750 is indeed not the same mouse as M650. It has an extra button that has been preprogrammed to trigger the Logi AI Prompt Builder once the user installs Logi Options+ app. Without Options+, the button does DPI toggle between 1,000 and 1,600 DPI.

However, a reprogrammable button south of a mouse’s scroll wheel that can be set to launch an app or toggle DPI out of the box is pretty common, including among Logitech mice. Logitech’s rep further claimed to me that the two mice use different electronic components, which Logitech refers to as the mouse’s platform. Logitech can reuse platforms for different models, the spokesperson said.

Logitech’s rep declined to comment on why the M650 didn’t have a button south of its scroll wheel. Price is a potential reason, but Logitech also sells cheaper mice with this feature.

Still, the minimal differences between the two suggest that the M750 isn’t worth a whole product release. I suspect that if it weren’t for Logitech’s trendy new software feature, the M750 wouldn’t have been promoted as a new product.

The M750 also raises the question of how many computer input devices need to be equipped with some sort of buzzy, generative AI-related feature.

Logitech’s ChatGPT prompt builder

Logitech’s much bigger release last week wasn’t a peripheral but an addition to its Options+ app. You don’t need the “new” M750 mouse to use Logitech’s AI Prompt Builder; I was able to program my MX Master 3S to launch it. Several Logitech mice and keyboards support AI Prompt Builder.

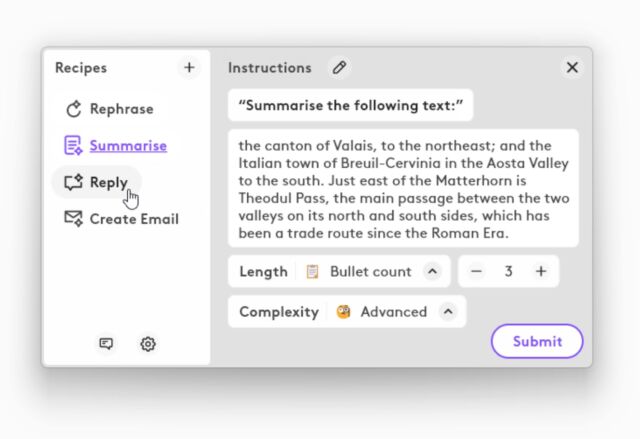

When you press a button that launches the prompt builder, an Options+ window appears. There, you can input text that Options+ will use to create a ChatGPT-appropriate prompt based on your needs:

Enlarge / A Logitech-provided image depicting its AI Prompt Builder software feature.

Logitech

After you make your choices, another window opens with ChatGPT’s response. Logitech said the prompt builder requires a ChatGPT account, but I was able to use GPT-3.5 without entering one (the feature can also work with GPT-4).

The typical Arsian probably doesn’t need help creating a ChatGPT prompt, and Logitech’s new capability doesn’t work with any other chatbots. The prompt builder could be interesting to less technically savvy people interested in some handholding for early ChatGPT experiences. However, I doubt if people with an elementary understanding of generative AI need instant access to ChatGPT.

The point, though, is instant access to ChatGPT capabilities, something that Logitech is arguing is worthwhile for its professional users. Some Logitech customers, though, seem to disagree, especially with the AI Prompt Builder, meaning that Options+ has even more resources in the background.

But Logitech isn’t the only gadget company eager to tie one-touch AI access to a hardware button.

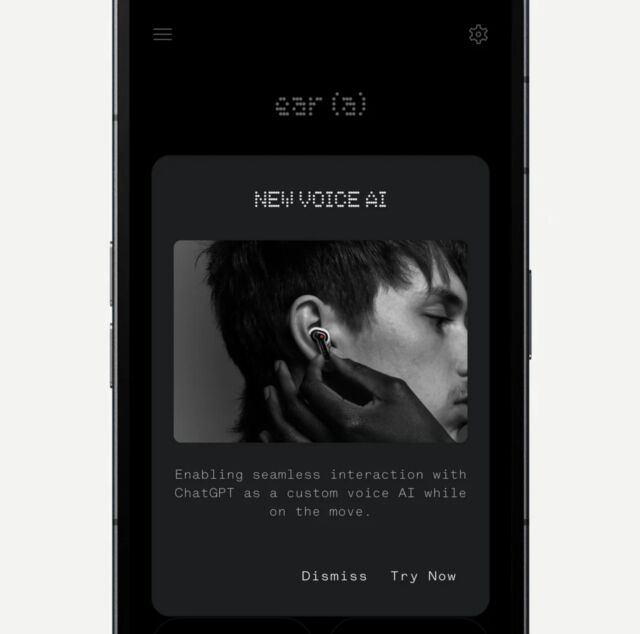

Pinching your earbuds to talk to ChatGPT

Similarly to Logitech, Nothing is trying to give its customers access to ChatGPT quickly. In this case, access occurs by pinching the device. This month, Nothing announced that it “integrated Nothing earbuds and Nothing OS with ChatGPT to offer users instant access to knowledge directly from the devices they use most, earbuds and smartphones.” The feature requires the latest Nothing OS and for the users to have a Nothing phone with ChatGPT installed. ChatGPT gestures work with Nothing’s Phone (2) and Nothing Ear and Nothing Ear (a), but Nothing plans to expand to additional phones via software updates.

Enlarge / Nothing’s Ear and Ear (a) earbuds.

Nothing

Nothing also said it would embed “system-level entry points” to ChatGPT, like screenshot sharing and “Nothing-styled widgets,” to Nothing smartphone OSes.

Enlarge / A peek at setting up ChatGPT integration on the Nothing X app.

Nothing’s ChatGPT integration may be a bit less intrusive than Logitech’s since users who don’t have ChatGPT on their phones won’t be affected. But, again, you may wonder how many people asked for this feature and how reliably it will function.

Tech brands are forcing AI into your gadgets—whether you asked for it or not Read More »