Intel details everything that could go wrong with US taking a 10% stake

Intel warns investors to brace for losses and uncertainties.

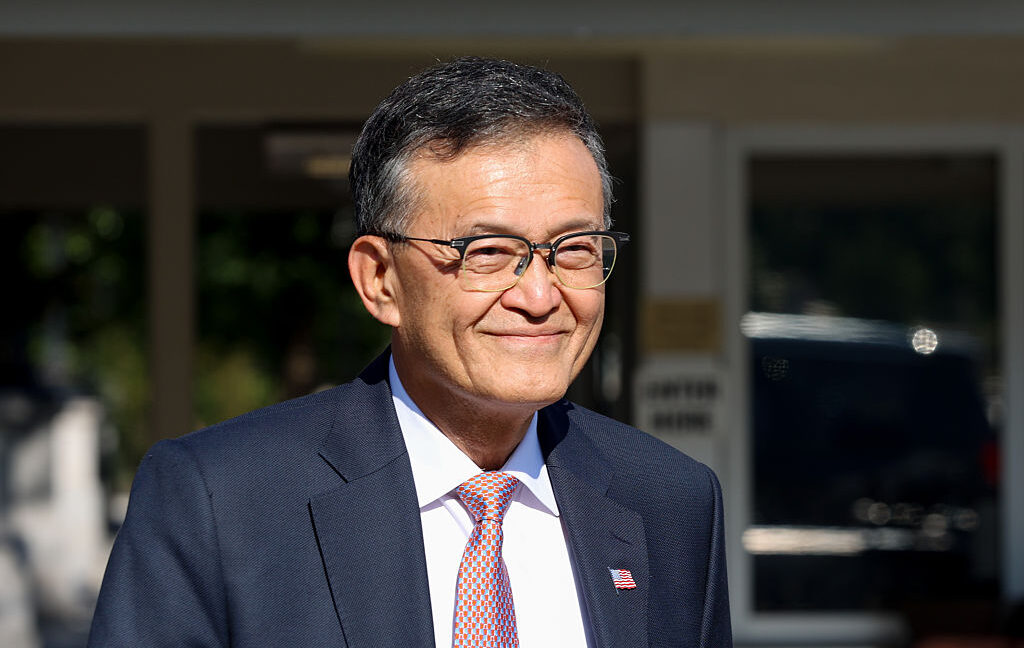

Some investors are not happy that Intel agreed to sell the US a 10 percent stake in the company after Donald Trump attacked Intel CEO Lip-Bu Tan with a demand to resign.

After Intel accepted the deal at a meeting with the president, it alarmed some investors when Trump boasted that his pressure campaign worked, claiming Tan “walked in wanting to keep his job, and he ended up giving us $10 billion for the United States.”

“It sets a bad precedent if the president can just take 10 percent of a company by threatening the CEO,” James McRitchie, a private investor and shareholder activist in California who owns Intel shares, told Reuters. To McRitchie, Tan accepting the deal effectively sent the message that “we love Trump, we don’t want 10 percent of our company taken away.”

McRitchie wasn’t the only shareholder who raised an eyebrow. Kristin Hull, chief investment officer of a California-based activist firm called Nia Impact Capital—which manages shares in Intel for its clients—told Reuters she has “more questions than confidence” about how the deal will benefit investors. To her, the deal seems to blur some lines “between where is the government and where is the private sector.”

As Reuters explains, Intel agreed to convert $11.1 billion in CHIPS funding and other grants “into a 9.9 percent equity stake in Intel.”

Some early supporters of the agreement—including tech giants like Microsoft and Trump critics like Bernie Sanders (I-Vt.)—have praised the deal as allowing the US to profit off billions in CHIPS grants that Intel was awarded under the Biden administration. After pushing for the deal, Commerce Secretary Howard Lutnick criticized Joe Biden for giving away CHIPS funding “for free,” while praising Trump for turning the CHIPS Act grants into “equity for the Trump administration” and “for the American people.”

But to critics of the deal, it seems weird for the US to swoop in and take stake in a company that doesn’t need government assistance. The only recent precedent was the US temporarily taking stake in key companies considered vital to the economy that risked going under during the 2008 financial crisis.

Compare that to the Intel deal, where Tan has made it clear that Intel, while struggling to compete with rivals, “didn’t need the money,” Reuters noted—largely due to SoftBank purchasing $2 billion in Intel shares in the days prior to the US agreement being reached. Instead, the US is incentivized to take the stake to help further Trump’s mission to quickly build up a domestic chip manufacturing supply chain that can keep the US a global technology leader at the forefront of AI innovation.

Investors told Reuters that it’s unusual for the US to take this much control over a company that’s not in crisis, noting that “this level of tractability was not usually associated with relations between businesses and Washington.”

Intel did not immediately respond to Ars’ request to comment on investors’ concerns, but a spokesperson told Reuters that Intel’s board has already approved the deal. In a press release, the company emphasized that “the government’s investment in Intel will be a passive ownership, with no Board representation or other governance or information rights. The government also agrees to vote with the Company’s Board of Directors on matters requiring shareholder approval, with limited exceptions.”

Intel reveals why investors should be spooked

The Trump administration has also stressed that the US stake in Intel does not give the Commerce Department any board seats or any voting or governance rights in Intel. Instead, the terms stipulate that the Commerce Department must “support the board on director nominees and proposals,” an Intel securities filing said.

However, the US can vote “as it wishes,” Intel reported, and experts suggested to Reuters that regulations may be needed to “limit government opportunities for abuses such as insider trading.” That could reassure investors somewhat, Rich Weiss, a senior vice president and chief investment officer of multi-asset strategies for American Century Investments, told Reuters. Without such laws, Weiss noted that “in an unchecked scenario of government direct investing, trading in those companies could be much riskier for investors.”

It also seems possible that the US could influence Intel’s decisions without the government explicitly taking voting control, experts suggested. “Several investors and representatives” told Reuters that the US could impact major decisions regarding things like layoffs or business shifts into foreign markets. At a certain point, Intel may be stuck choosing between corporate and national interests, Robert McCormick, executive director of the Council of Institutional Investors, told Reuters.

“A government stake in an otherwise private entity potentially creates a conflict between what’s right for the company and what’s right for the country,” McCormick suggested.

Further, Intel becoming partly state-controlled risks disrupting Intel’s non-US business, subjecting the company to “additional regulations, obligations or restrictions, such as foreign subsidy laws or otherwise, in other countries,” Intel’s filing said.

In the filing, Intel confirmed directly to investors that they have good cause to be spooked by the US stake. Offering a bulleted list, the company outlined “a number of risks and uncertainties” that could “adversely impact” shareholders due to “the US Government’s ownership of significant equity interests in the company.”

Perhaps most alarming in the short term, Intel admitted that the deal will dilute investors’ stock due to the discounted shares issued to Trump. And their shares could suffer additional dilutions if certain terms of the deal are “triggered” or “exercised,” Intel noted.

In the long term, investors were told that the US stake may limit the company’s eligibility for future federal grants while leaving Intel shareholders dwelling in the uncertainty of knowing that terms of the deal could be voided or changed over time, as federal administration and congressional priorities shift.

Additionally, Intel forecasted potential legal challenges over the deal, which Intel anticipates could come from both third parties and the US government.

The final bullet point in Intel’s risk list could be the most ominous, though. Due to the unprecedented nature of the deal, Intel fears there’s no way to anticipate myriad other challenges the deal may trigger.

“It is difficult to foresee all the potential consequences,” Intel’s filing said. “Among other things, there could be adverse reactions, immediately or over time, from investors, employees, customers, suppliers, other business or commercial partners, foreign governments or competitors. There may also be litigation related to the transaction or otherwise and increased public or political scrutiny with respect to the Company.”

Meanwhile, it’s hard to see what Intel truly gains from the deal other than maybe getting Trump off its back for a bit. A Fitch Ratings research note reported that “the deal does not improve Intel’s BBB credit rating, which sits just above junk status” and “does not fundamentally improve customer demand for Intel chips” despite providing “more liquidity,” Reuters reported.

Intel’s filing, in addition to rattling investors, likely also serves as a warning sign to other companies who may be approached by the Trump administration to strike similar deals. So far, the administration has confirmed that the US is not eyeing a stake in Nvidia and seems unlikely to seek a stake in the Taiwan Semiconductor Manufacturing Company. While Lutnick has said he plans to push to make more deals, any chipmakers committing to increasing investments in the US, sources told the Wall Street Journal, will supposedly be spared from pressure to make a similar deal.

Intel details everything that could go wrong with US taking a 10% stake Read More »