DOGE “cut muscle, not fat”; 26K experts rehired after brutal cuts

Government brain drain will haunt US after DOGE abruptly terminated.

Billionaire Elon Musk, the head of the Department of Government Efficiency (DOGE), holds a chainsaw as he speaks at the annual Conservative Political Action Conference. Credit: SAUL LOEB / Contributor | AFP

After Donald Trump curiously started referring to the Department of Government Efficiency exclusively in the past tense, an official finally confirmed Sunday that DOGE “doesn’t exist.”

Talking to Reuters, Office of Personnel Management (OPM) Director Scott Kupor confirmed that DOGE—a government agency notoriously created by Elon Musk to rapidly and dramatically slash government agencies—was terminated more than eight months early. This may have come as a surprise to whoever runs the DOGE account on X, which continued posting up until two days before the Reuters report was published.

As Kupor explained, a “centralized agency” was no longer necessary, since OPM had “taken over many of DOGE’s functions” after Musk left the agency last May. Around that time, DOGE staffers were embedded at various agencies, where they could ostensibly better coordinate with leadership on proposed cuts to staffing and funding.

Under Musk, DOGE was hyped as planning to save the government a trillion dollars. On X, Musk bragged frequently about the agency, posting in February that DOGE was “the one shot the American people have to defeat BUREAUcracy, rule of the bureaucrats, and restore DEMOcracy, rule of the people. We’re never going to get another chance like this.”

The reality fell far short of Musk’s goals, with DOGE ultimately reporting it saved $214 billion—an amount that may be overstated by nearly 40 percent, critics warned earlier this year.

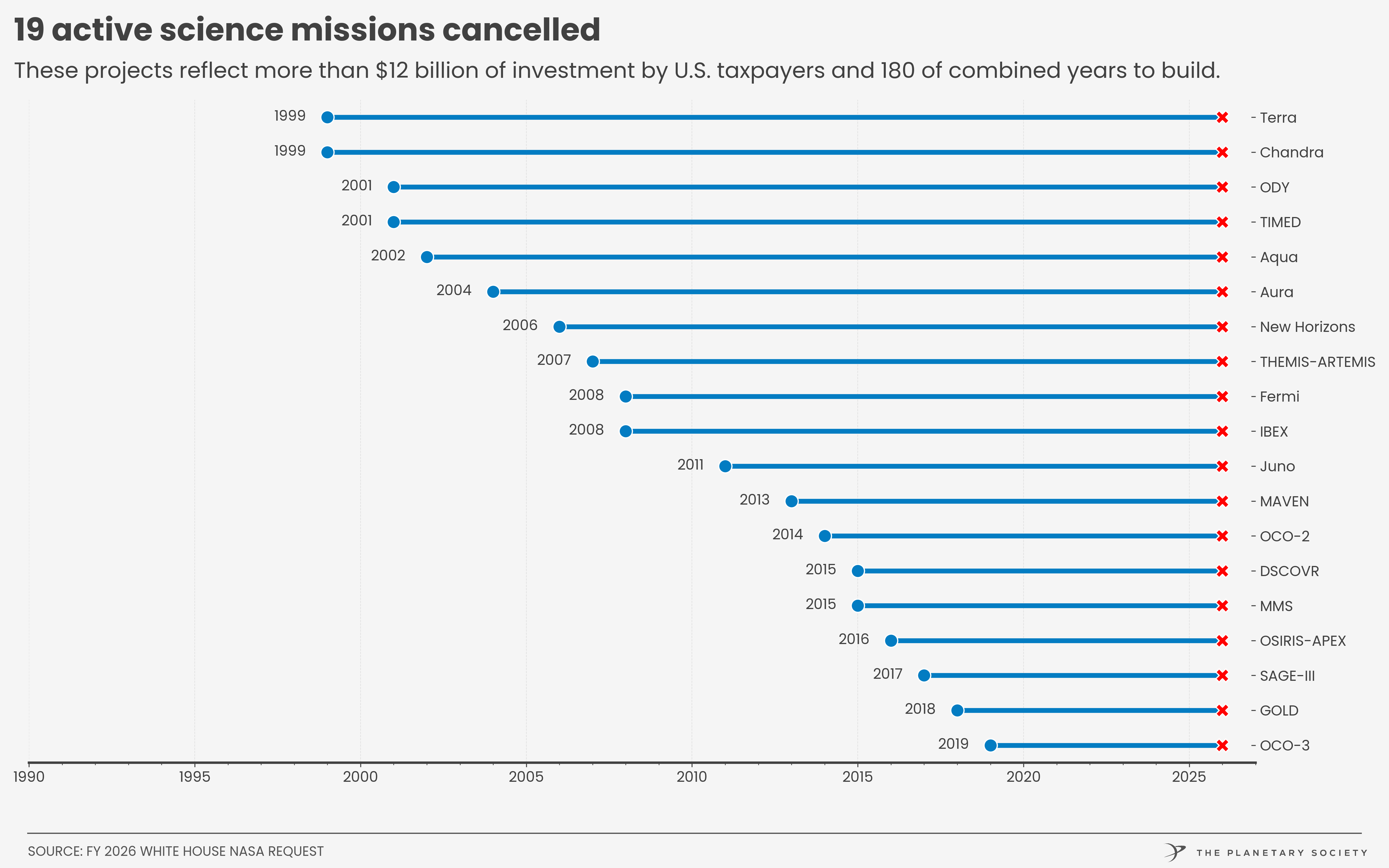

How much talent was lost due to DOGE cuts?

Once Musk left, confidence in DOGE waned as lawsuits over suspected illegal firings piled up. By June, Congress was drawn, largely down party lines, on whether to codify the “DOGE process”—rapidly firing employees, then quickly hiring back whoever was needed—or declare DOGE a failure—perhaps costing taxpayers more in the long term due to lost talent and services.

Because DOGE operated largely in secrecy, it may be months or even years before the public can assess the true cost of DOGE’s impact. However, in the absence of a government tracker, the director of the Center for Effective Public Management at the Brookings Institution, Elaine Kamarck, put together what might be the best status report showing how badly DOGE rocked government agencies.

In June, Kamarck joined other critics flagging DOGE’s reported savings as “bogus.” In the days before DOGE’s abrupt ending was announced, she published a report grappling with a critical question many have pondered since DOGE launched: “How many people can the federal government lose before it crashes?”

In the report, Kamarck charted “26,511 occasions where the Trump administration abruptly fired people and then hired them back.” She concluded that “a quick review of the reversals makes clear that the negative stereotype of the ‘paper-pushing bureaucrat’” that DOGE was supposedly targeting “is largely inaccurate.”

Instead, many of the positions the government rehired were “engineers, doctors, and other professionals whose work is critical to national security and public health,” Kamarck reported.

About half of the rehires, Kamarck estimated, “appear to have been mandated by the courts.” However, in about a quarter of cases, the government moved to rehire staffers before the court could weigh in, Kamarck reported. That seemed to be “a tacit admission that the blanket firings that took place during the DOGE era placed the federal government in danger of not being able to accomplish some of its most important missions,” she said.

Perhaps the biggest downside of all of DOGE’s hasty downsizing, though, is a trend in which many long-time government workers simply decided to leave or retire, rather than wait for DOGE to eliminate their roles.

During the first six months of Trump’s term, 154,000 federal employees signed up for the deferred resignation program, Reuters reported, while more than 70,000 retired. Both numbers were clear increases (tens of thousands) over exits from government in prior years, Kamarck’s report noted.

“A lot of people said, ‘the hell with this’ and left,” Kamarck told Ars.

Kamarck told Ars that her report makes it obvious that DOGE “cut muscle, not fat,” because “they didn’t really know what they were doing.”

As a result, agencies are now scrambling to assess the damage and rehire lost talent. However, her report documented that agencies aligned with Trump’s policies appear to have an easier time getting new hires approved, despite Kupor telling Reuters that the government-wide hiring freeze is “over.” As of mid-November 2025, “of the over 73,000 posted jobs, a candidate was selected for only about 14,400 of them,” Kamarck reported, noting that it was impossible to confirm how many selected candidates have officially started working.

“Agencies are having to do a lot of reassessments in terms of what happened,” Kamarck told Ars, concluding that DOGE “was basically a disaster.”

A decentralized DOGE may be more powerful

“DOGE is not dead,” though, Kamarck said, noting that “the cutting effort is definitely” continuing under the Office of Management and Budget, which “has a lot more power than DOGE ever had.”

However, the termination of DOGE does mean that “the way it operated is dead,” and that will likely come as a relief to government workers who expected DOGE to continue slashing agencies through July 2026 at least, if not beyond.

Many government workers are still fighting terminations, as court cases drag on, and even Kamarck has given up on tracking due to inconsistencies in outcomes.

“It’s still like one day the court says, ‘No, you can’t do that,’” Kamarck explained. “Then the next day another court says, ‘Yes, you can.’” Other times, the courts “change their minds,” or the Trump administration just doesn’t “listen to the courts, which is fairly terrifying,” Kamarck said.

Americans likely won’t get a clear picture of DOGE’s impact until power shifts in Washington. That could mean waiting for the next presidential election, or possibly if Democrats win a majority in midterm elections, DOGE investigations could start as early as 2027, Kamarck suggested.

OMB will likely continue with cuts that Americans appear to want, as White House spokesperson Liz Huston told Reuters that “President Trump was given a clear mandate to reduce waste, fraud and abuse across the federal government, and he continues to actively deliver on that commitment.”

However, Kamarck’s report noted polls showing that most Americans disapprove of how Trump is managing government and its workforce, perhaps indicating that OMB will be pressured to slow down and avoid roiling public opinion ahead of the midterms.

“The fact that ordinary Americans have come to question the downsizing is, most likely, the result of its rapid unfolding, with large cuts done quickly regardless of their impact on the government’s functioning,” Kamarck suggested. Even Musk began to question DOGE. After Trump announced plans to appeal an electrical vehicle mandate that the Tesla founder relied on, Musk posted on X, “What the heck was the point of DOGE, if he’s just going to increase the debt by $5 trillion??”

Facing “blowback” over the most unpopular cuts, agencies sometimes rehired cut staffers within 24 hours, Kamarck noted, pointing to the Department of Energy as one of the “most dramatic” earliest examples. In that case, Americans were alarmed to see engineers cut who were responsible for keeping the nation’s nuclear arsenal “safe and ready.” Retention for those posts was already a challenge due to “high demand in the private sector,” and the number of engineers was considered “too low” ahead of DOGE’s cuts. Everyone was reinstated within a day, Kamarck reported.

Alarm bells rang across the federal government, and it wasn’t just about doctors and engineers being cut or entire agencies being dismantled, like USAID. Even staffers DOGE viewed as having seemingly less critical duties—like travel bookers and customer service reps—were proven key to government functioning. Arbitrary cuts risked hurting Americans in myriad ways, hitting their pocketbooks, throttling community services, and limiting disease and disaster responses, Kamarck documented.

Now that the hiring freeze is lifted and OMB will be managing DOGE-like cuts moving forward, Kamarck suggested that Trump will face ongoing scrutiny over Musk’s controversial agency, despite its dissolution.

“In order to prove that the downsizing was worth the pain, the Trump administration will have to show that the government is still operating effectively,” Kamarck wrote. “But much could go wrong,” she reported, spouting a list of nightmare scenarios:

“Nuclear mismanagement or airline accidents would be catastrophic. Late disaster warnings from agencies monitoring weather patterns, such as the National Oceanic and Atmospheric Administration (NOAA), and inadequate responses from bodies such as the Federal Emergency Management Administration (FEMA), could put people in danger. Inadequate staffing at the FBI could result in counter-terrorism failures. Reductions in vaccine uptake could lead to the resurgence of diseases such as polio and measles. Inadequate funding and staffing for research could cause scientists to move their talents abroad. Social Security databases could be compromised, throwing millions into chaos as they seek to prove their earnings records, and persistent customer service problems will reverberate through the senior and disability communities.”

The good news is that federal agencies recovering from DOGE cuts are “aware of the time bombs and trying to fix them,” Kamarck told Ars. But with so much brain drain from DOGE’s first six months ripping so many agencies apart at their seams, the government may struggle to provide key services until lost talent can be effectively replaced, she said.

“I don’t know how quickly they can put Humpty Dumpty back together again,” Kamarck said.

DOGE “cut muscle, not fat”; 26K experts rehired after brutal cuts Read More »