Stellantis swallows $26 billion costs as it rethinks its EV strategy

The automotive industry’s big bet on a rapid adoption of electric vehicles—at least here in the United States—continues to unwind. Today, Stellantis, which owns brands like Jeep and Dodge, as well as Fiat, Peugeot, and others, announced that it has “reset” its business to adapt to reality, which comes with a rather painful $26.2 billion (22.2 billion euro) write-down.

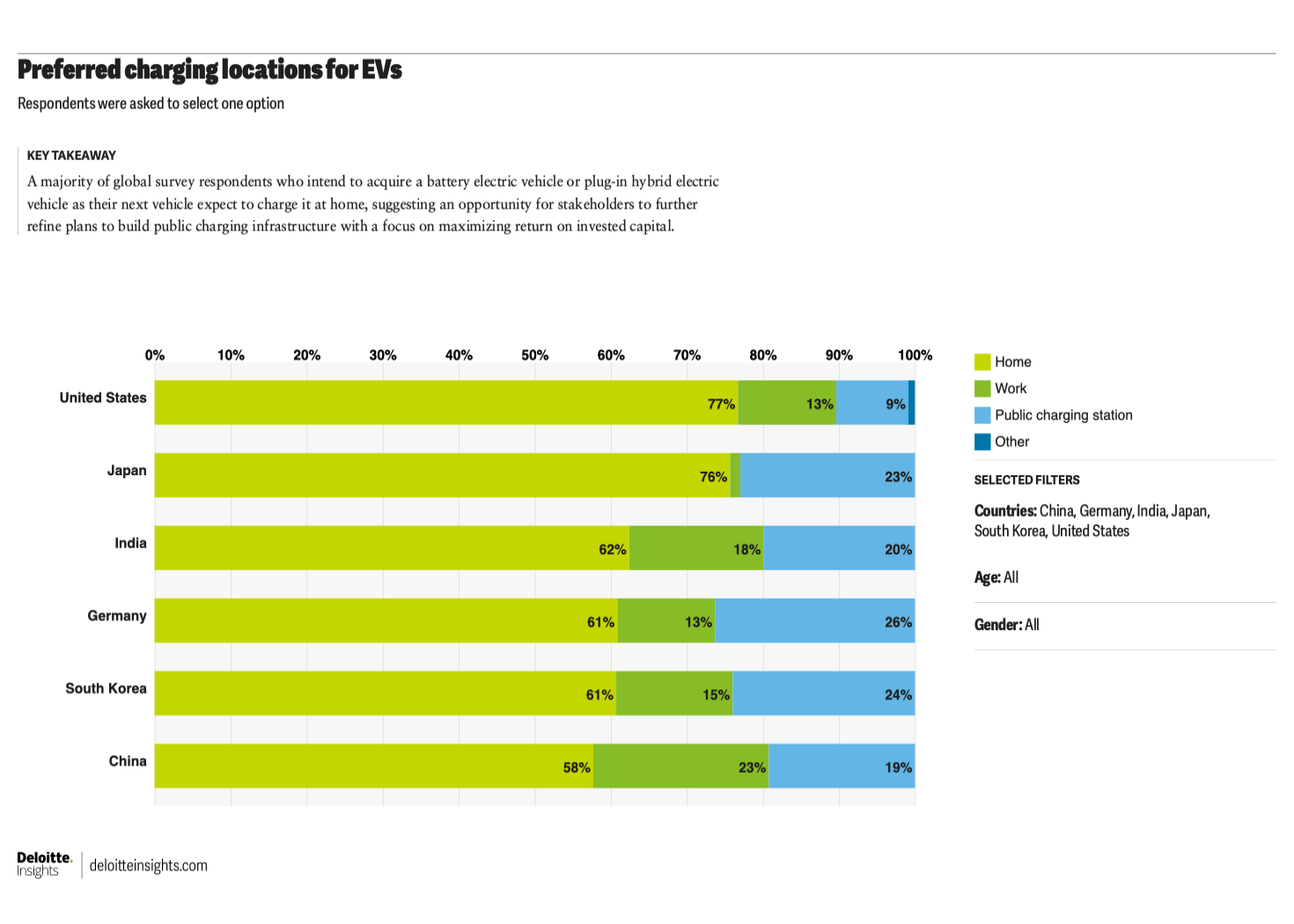

It wasn’t that long ago that everyone was more bullish on electrification. Even the US had relatively ambitious plans to boost EV adoption into the next decade, including a big commitment to charging infrastructure. Ten new battery factories were announced, and the future looked bright.

Not everyone agreed. Some automakers, having been left behind by the push toward battery EVs and away from simple hybrids that offered little in the way of true decarbonization, lobbied hard to relax fuel efficiency standards. Car dealers, uncomfortable with the prospect of investing in and learning about new technology, did so, too. When the Republican Party won the 2024 election, the revanchists got their wish.

Gone were the incentives to consumers and businesses to buy EVs, which helped offset the higher purchase price. Out went funding for that national network of high-speed chargers. Tough future emissions standards were torn up, and inefficient and polluting gasoline engines will instead be the order of the day. And automakers were told to forget about being fined under the existing regulations—”sell as many gas-guzzlers as you like” was the message. (But also, bizarrely, import those tiny Japanese Kei cars, too.)

Reality bites

Stellantis is hardly alone in feeling this pain; in December, Ford announced a $19.5 billion write-down as it reprioritized combustion-engine platforms going forward. GM followed in early January with news that canceling some of its EV plans would cost the company $6 billion. Neither bill is quite as large as the one facing Stellantis (and its shareholders).

Stellantis swallows $26 billion costs as it rethinks its EV strategy Read More »