“Streaming stops feeling infinite”: What subscribers can expect in 2026

Spoiler: expect higher prices

Streaming may get a little worse before it gets better.

We’re far from streaming’s original promise: instant access to beloved and undiscovered titles without the burden of ads, bundled services, or price gouging that have long been associated with cable.

Still, every year we get more dependent on streaming for entertainment. Despite streaming services’ flaws, many of us are bound to keep subscribing to at least one service next year. Here’s what we can expect in 2026 and beyond.

Subscription prices keep rising, but perhaps not as expected

There’s virtually no hope of streaming subscription prices plateauing in 2026. Streaming companies continue to face challenges as content production and licensing costs rise, and it’s often easier to get current customers to pay slightly more than to acquire new subscribers. Meanwhile, many streaming companies are still struggling with profitability and revenue after spending years focusing on winning subscribers with content.

“We see many services are only now aligning content spend with realistic lifetime value per subscriber,” Christofer Hamilton, industry insights manager at streaming analyst Parrot Analytics, told Ars.

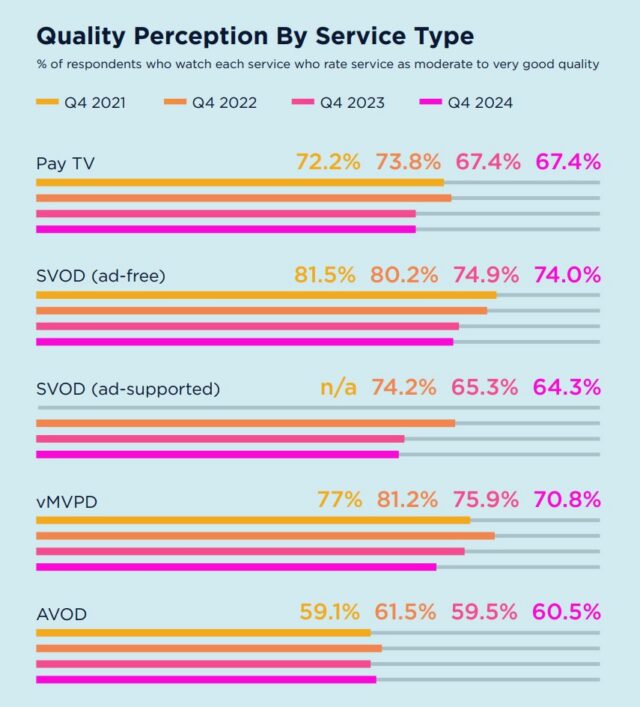

Companies may get more creative with how they frame higher costs to subscribers, however. People who pay extra to stream without ads are the most likely to see price bumps as streaming companies continue pushing customers toward ad-based tiers.

Charging more for “premium” features—such as 4K streaming, simultaneous streams, or offline downloads—offers another way for streaming companies to boost revenue without implementing broad price hikes that risk provoking customer outrage. Subscribers can expect streaming prices to get “more menu-like next year,” said Michael Goodman, director of entertainment research at Parks Associates, a research firm focusing on IoT, consumer electronics, and entertainment.

When will the price hikes stop?

If streaming prices won’t stop rising next year, when will they?

Ultimately, it may be up to subscribers to vote with their dollars by canceling subscriptions or opting for cheaper or free alternatives, such as FAST (free ad-supported streaming television) channels with linear programming.

As Goodman put it, “Until we see net adds stall or decline as a result of price hikes, services have no incentive to stop raising prices.”

Some experts doubt that streaming services will ever willingly stop increasing prices. Bill Yousman, professor and director of the Media Literacy and Digital Culture graduate program at Sacred Heart University, sees precedent for this in cable companies.

“If the big streaming companies had their way, there would be no limit to their price hikes. We have already seen this with the cable monopolies and their disregard for consumer dissatisfaction,” he said.

Yousman believes that prices will only “be brought under control if there is some type of government regulation,” but he noted that’s unlikely under the Trump administration.

To date, US lawmakers haven’t shown interest in halting the steady rise of streaming prices. Most lawmakers who have sought to regulate the industry have focused on industry consolidation. There has been some effort from lawmakers to rein in streaming price hikes, though, especially through proposed federal legislation dubbed the Price Gouging Prevention Act.

Streaming services lean deeper into cable-like bundles

Companies will look to leverage subscribers’ frustration with pricing by being more aggressive about bundling third-party services like traditional pay TV, Internet, and cell phone service with streaming subscriptions. The idea is that people are less likely to cancel a streaming subscription if it’s tied to a different subscription (including another streaming subscription). The strategy echoes the days of cable, when some people kept unused landlines just to save money on cable channels or Internet service.

“For subscribers, 2026 is the year streaming stops feeling infinite and starts feeling more like premium cable used to: fewer apps, clearer bundles, and higher expectations for each service they pay for,” Parrot’s Hamilton said.

Thanks to traditional pay TV providers, bundles have a bad connotation among people looking to save money and simplify their subscriptions. But bundling doesn’t always have to be a bad thing, as Yousman explains:

If the companies wanted to really be responsive to consumers, they would let them design their own packages rather than having to choose options that may or may not include all the services they want. What works against this, of course, is the demand for ever-increasing profits at all times.

Should a sale of Warner Bros. Discovery’s (WBD’s) HBO Max be completed (late) next year, subscribers will face more pressure to bundle their streaming subscriptions.

“When dominant platforms like Netflix or Paramount absorb major content players, it accelerates the erosion of streaming’s original promise: freedom from monopolistic bundles,” Vikrant Mathur, co-founder of streaming technology provider Future Today, said.

Netflix and Paramount duke it out over Warner Bros.

WBD announced plans this month to sell its streaming and movie studios business to Netflix for an equity value of $72 billion, or an approximate total enterprise value of $82.7 billion. Paramount Skydance, however, quickly swooped in with a hostile takeover bid for all of WBD, including its cable channels, for $108.4 billion. A WBD shareholder vote will occur in spring or early summer, chairman Samuel Di Piazza told CNBC. By the end of 2026, we should have a clearer understanding of the future of HBO Max, as well as Netflix and Paramount+.

Any acquisition will be subject to regulatory scrutiny, causing more uncertainty for subscribers. If Netflix buys HBO Max, users of both services can expect higher prices due to reduced competition and the extensive amount of content and number of big-budget franchises (including Harry Potter and DC Comics) expected to unite under one platform.

“If Netflix gets [HBO Max] and the WB studios, HBO Max subscribers are more likely to see a smoother transition, strong ongoing investment in premium content, and simpler app/billing integration,” Parks Associates’ Goodman said.

But while the potential merger is worth watching, subscribers are unlikely to truly feel the impact of HBO Max potentially changing ownership until after 2026.

“Producing a show is a yearslong process, so the content that was already slated to air isn’t going to disappear, and the new content acquired through the WB library won’t be available until the merger is approved and closes,” Tre Lovell, attorney and owner of Los Angeles entertainment law firm The Lovell Firm, explained.

Content starts getting less bold

Looking beyond 2026, a sale of part or all of WBD would likely open the door for more streaming acquisitions. That could eventually benefit customers by making it easier to find content to watch with fewer subscriptions. But merged companies are also less likely to take risks on unique and diverse content.

Analysts I spoke with pointed to fewer niche and mid-tier original shows and movies and more show cancellations if either Netflix or Paramount buys HBO Max. Either buyer would probably focus more on the already-successful franchises that WB owns, such as Game of Thrones, Batman, and Superman.

“Big combined libraries push companies to double down on proven IP because it travels, merchandises, and reduces marketing risk,” said Robert Rosenberg, a partner at the New York law firm Moses Singer focusing on intellectual property, entertainment, technology, and data law.

Rosenberg also expects to see a “tilt toward” live events, sports, and unscripted content “for retention” if HBO Max sells.

In the shorter term, Rory Gooderick, research manager at analyst firm Ampere Analysis, predicted that WBD will be “cautious when greenlighting new large-scale projects until” the acquisition is finalized.

Beyond the potential HBO Max sale, more merger activity could lead to streaming services straying from their original selling point of offering bolder, quirkier content.

As the industry consolidates, “sticky content,” like procedurals, reality shows, and “comfort TV that drives long viewing sessions,” will take priority among mainstream, subscription-based streaming services, especially as they put more emphasis on ad-tier subscriptions, Goodman predicted.

A more stable future?

The new year will be formative for streaming and yield lasting impacts for subscribers. We’ve discussed numerous negative implications, but there could be a silver lining. While we may see more turbulence, hopefully, we’ll also start to see a road toward more stable streaming options.

Streaming subscribers can’t directly stop mergers or price hikes or control streaming libraries. But with services like Netflix and Disney+ focusing on becoming one-stop shops with massive libraries, there’s an opportunity for other services to hone their specialties and stand out by providing offbeat, unexpected, and rare content at more affordable prices.

As the landscape settles, streamers should be mindful of the importance of variety to subscribers. According to Bill Michels, chief product officer at Gracenote, Nielsen’s content data business unit:

There will be some consolidation. But the [connected TV] landscape, inclusive of FAST and [direct-to-consumer] channels, provides more than ample video variety for viewers, so the biggest challenge will be connecting content with the right audience. Audience engagement depends on good content. Audience retention depends on making sure audiences are never without something to watch.

“Streaming stops feeling infinite”: What subscribers can expect in 2026 Read More »