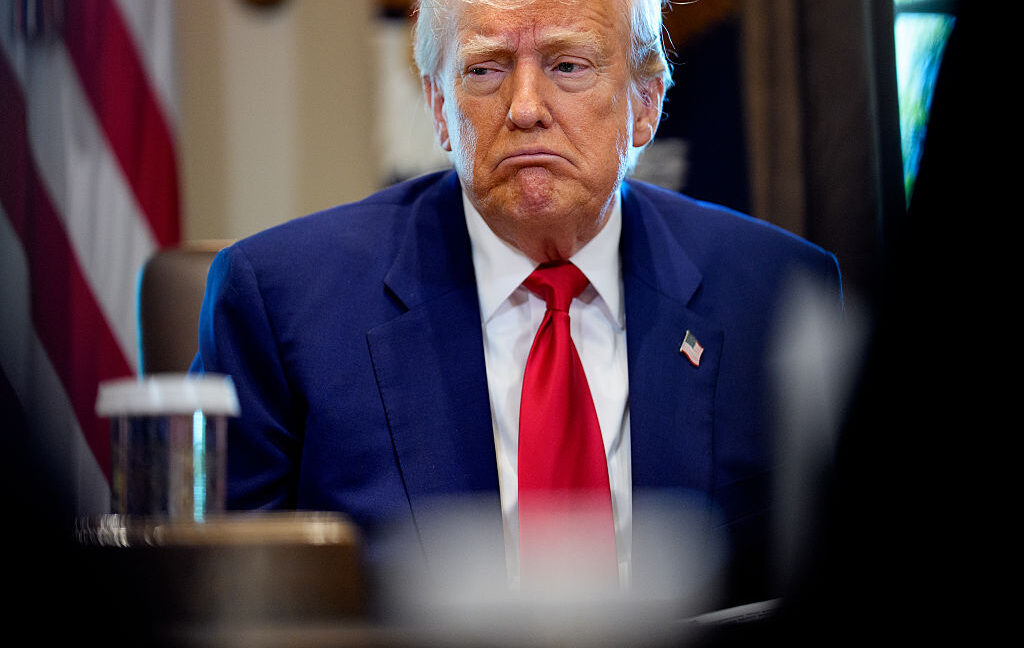

Trump suggests he needs China to sign off on TikTok sale, delays deal again

For many Americans, losing TikTok would be disruptive. TikTok has warned that US businesses could lose $1 billion in one month if TikTok shuts down. As these businesses wait in limbo for a resolution to the situation, it’s getting harder to take the alleged national security threat seriously, as clinching the deal appears to lack urgency.

On Wednesday, the White House continued to warn that Americans are not safe using TikTok, though, despite leaving Americans vulnerable for an extended period that could now stretch to eight months.

In a statement, White House press secretary Karoline Leavitt only explained that “President Trump does not want TikTok to go dark” and would sign an executive order “to keep TikTok up and running” through mid-September. Leavitt confirmed that the Trump administration would focus on finishing the deal in this three-month period, “making sure the sale closes so that Americans can keep using TikTok with the assurance that their data is safe and secure,” Reuters reported.

US-China tensions continue, despite truce

Trump’s negotiations with China have been shaky, but a truce was reestablished last week that could potentially pave the way for a TikTok deal.

Initially, Trump had planned to use the TikTok deal as a bargaining chip, but the tit-for-tat retaliations between the US and China all spring reportedly left China hesitant to agree to any deal. Perhaps sensing the power shift in negotiations, Trump offered to reduce China’s highest tariffs to complete the deal in March. But by April, analysts opined that Trump was still “desperate” to close, while China saw no advantage in letting go of TikTok any time soon.

Despite the current truce, tensions between the US and China continue, as China has begun setting its own deadlines to maintain leverage in the trade war. According to The Wall Street Journal, China put a six-month limit “on the sales of rare earths to US carmakers and manufacturers, giving Beijing leverage if the trade conflict flares up again.”

Trump suggests he needs China to sign off on TikTok sale, delays deal again Read More »